|

Subscribe / Renew |

|

|

Contact Us |

|

| ► Subscribe to our Free Weekly Newsletter | |

| home | Welcome, sign in or click here to subscribe. | login |

Construction

| |

|

March 26, 2015

Downtown office space will jump 23% in 18 months

Broderick Group

Sweeney

|

Imagine shopping for your Seahawks jersey the Friday before the Super Bowl. You feel you must have new gear, but everything is picked over, and what is left is the wrong size and 75 percent more expensive than during preseason games.

This is what office tenants have been facing as they look to secure new and expanding space in the Bellevue CBD. There are simply too few choices at premium rates.

Rental rates for the best spaces and buildings are $35-$40 per square foot, making the Bellevue CBD the most expensive submarket in the entire Puget Sound region. Once operating expenses — real estate taxes, janitorial services, utilities, building management and maintenance — are considered, the total can be over $50 per square foot annually, excluding parking.

These rental rates are tame by San Francisco standards, but are 75 percent higher than when most office tenants last shopped for new space following the 2008 recession.

In regards to supply, any vacancy rate lower than 10 percent signifies a tight, landlord’s market with increasing rents. Vacancy rates for Class A office space in the Bellevue CBD are 7.4 percent, with the premium buildings at less than 5 percent.

Recruiting tool

Over the 28 years of my career, the view of office space by tenants in our area has transitioned from that of a necessary expense to a very important asset, mainly as a recruiting tool.

Most of Bellevue’s office market is made up of technology tenants that are competing for the best and brightest employees. As such they need to offer the best office space and location.

Technology has allowed greater efficiencies in space usage, and as a result companies are averaging densities between five and seven people per 1,000 square feet versus the historical three to four.

Parking ratios have remained at four per 1,000 square feet or less in suburban Bellevue, which means that companies must provide convenient mass transit options to make up the difference. Additionally employees want a “walkable” 24-hour environment with restaurants and retail, nearby housing, and hotels for visitors and conferences.

Downtown Bellevue is the place to go for all these required amenities, and companies are willing to pay accordingly. For example, comparably aged buildings along I-90 in Bellevue are $18-$21 per square foot less costly per year ($23-$27 including parking) than downtown Bellevue — an incredible disparity that never existed before.

Clearly, office tenants are “paying up” for downtown Bellevue.

This rent disparity was created by Bellevue technology companies paying average salaries of $167,000 to attract top workers. With an additional $18,000 for benefits such as health insurance and retirement, the totals come in at a staggering $185,000 per year per employee.

Translating those figures to the language of office space leasing, using six workers in 1,000 square feet as average occupancy, it equates to $1,110 per square foot per year being spent to attract talent.

With that employment cost per square foot in mind, it is easy to see why tenants might think $50 per square foot annually in rental costs is a bargain to secure the best office space and location on the Eastside. The average worker spends over half of their work week in their office so the quality of office space, ease of access to it, and neighboring amenities becomes a very large component in deciding which company a prospective employee chooses.

The result of all this is a very tight downtown Bellevue office market and rents at historic highs finally driving new construction.

But, relief is on the way.

Under construction

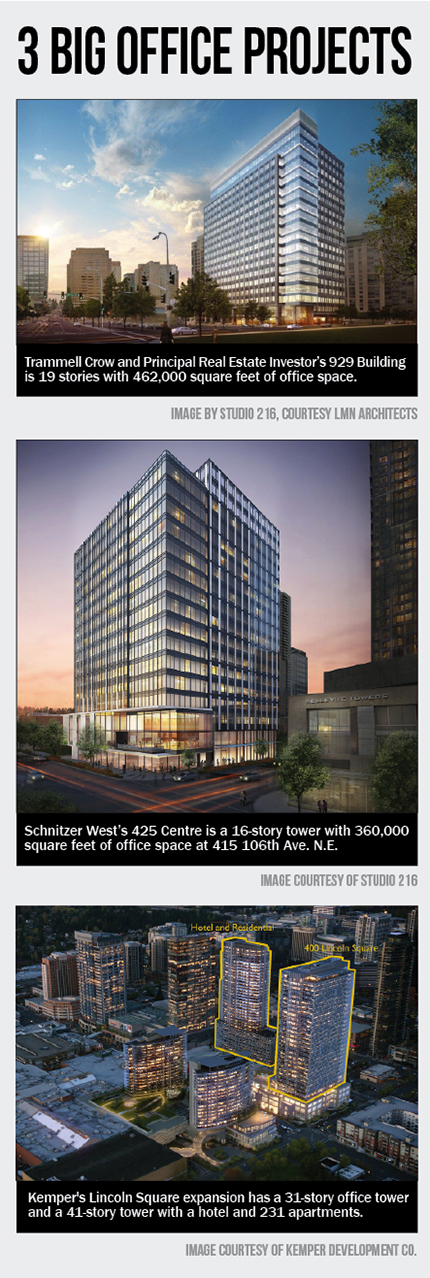

Opening December 2015: Trammell Crow and Principal Real Estate Investor’s 929 Building is 19 stories that will deliver 462,000 square feet of office space at 833 108th Ave. N.E. The building has large common areas, an athletic facility, conference rooms, and the desired downtown location within walking distance to the Bellevue Transit Center.

October 2016 (approximate): Schnitzer’s 425 Centre at 415 106th Ave. N.E. will add 354,000 square feet in a 16-story building, also comprised of attractive large common areas, an athletic facility, conference rooms and easy access to the transit center.

November 2016: Kemper Development’s Lincoln Square expansion will deliver a 31-story, 715,000-square-foot office tower; a 41-story tower with a 245-room four-star hotel and 231 luxury apartments; and 180,000 square feet of retail and restaurants. All will connect to Kemper’s existing 4 million square feet of office, retail, hotel and residential properties.

The Lincoln Square expansion will offer the most iconic tower, best amenities, views, and access to retail and hotels, albeit at a premium over the others.

Planned

Waiting in the wings is the Summit III site at Northeast Fourth and 108th, recently purchased by Hines. The garage is complete and there is only a 16-month delivery timeline to provide an additional 333,000 square feet of office space in a 15-story building.

These new buildings, including Summit III, add approximately 1.9 million square feet to a downtown Bellevue market that is now only 8.2 million square feet. This represents a 23 percent increase in inventory in a short 18 months.

Since the late 80s, Microsoft has been the driver of the market, currently occupying 26 percent of the entire Eastside office market, and over 21 percent of the space in downtown Bellevue. In years past they would readily lease a large percentage of this new construction space. However, Microsoft’s appetite for speculative space has paused and that leaves opportunities for the new and growing tenants looking to capitalize on both premium new offices and the Eastside’s wealth of educated talent.

Supply is clearly on the way, and it will be provided with these new buildings that offer higher floor-to-ceiling heights, more natural light with improved exterior window design, improved views in some cases, and electrical and cooling standards that better meet the technology requirements of today’s tenants.

Despite the extreme construction costs to provide better office space, rental rates will still be in the $35-$42 per square foot range ($48-$55 including expenses) for these new buildings as the increased competition puts at least a temporary lid on continuing rent increases.

The wait is over as tenants are already signing leases and soliciting proposals for the new space. It remains to be seen if it is too much or not enough new construction, but regardless it will provide a welcome relief to those companies that seek the best in Eastside office space for their highly valued employees.

Paul Sweeney is a principal and co-founder of Broderick Group, a Seattle- and Bellevue-based commercial real estate brokerage.

Other Stories:

- Bellevue blooms with construction cranes

- Homogeneous? Boring? No way! Why one new millennial loves Bellevue

- What can Bellevue learn from other big cities?

- Retail drives growth in once ‘sleepy’ downtown