Surveys

DJC.COM

December 11, 2003

The recovery train has left the station: Are we on it?

University of Washington

What a difference a year makes. Last year at this time, I wrote an article for the Daily Journal of Commerce entitled “Seattle's Economy: Out of Sync?” The basic theme of that article was that we should give some careful thought regarding what to do to get our local economy in sync with the broader national economy, assuming we could agree that we cared about our relative performance.

As it turns out, the question was somewhat moot, given the fact that the U.S. economy struggled throughout much of the year. However, by the end of the summer, the economy did manage to avoid slipping back into recession, setting fears of deflation behind us.

Over the past several months, the stars continued to line up, suggesting that the national economy would emerge from the doldrums. Evidence of this reversal of fortunes is fairly widespread, with the stock market gaining ground and business confidence picking up. This can be attributed to a number of factors, including low interest rates and some aggressive actions out of Washington to stimulate consumer spending and business investment.

Given the economic revival, as we go into 2004 the question of our relative role takes on a more urgent tone since there is a danger of standing out as a sub-performing market.

Whether we catch the train of recovery or are left back at the station is an important question, given the importance of external capital flows to support our economy, and the dependence of such flows on transparency and perceptions.

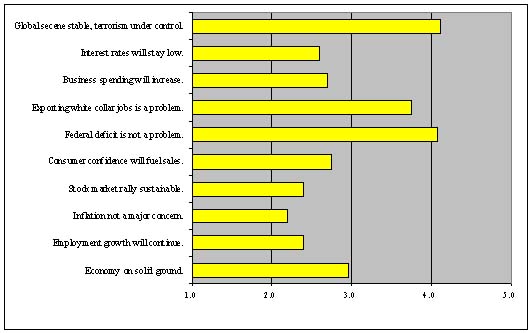

I conduct surveys of local professionals regarding the economy, the real estate market and the issues/opportunities faced by our region. My comments here are based on the results of our latest survey, which included responses from over 60 local business professionals.

Recovery on track

Local real estate professionals believe that the national economic recovery will stay on track, growth will continue to improve and employers will add much-needed jobs. They expect interest rates to stay low and inflation to remain in check. They are properly concerned about the longer-term impacts of deficit spending, exporting of white-collar jobs, the trade imbalance and the on-going threat of terrorism and global conflict. However, these concerns are not sufficient to dampen their optimism, at least for the near-to-intermediate future.

On the local front, professionals are resigned to the fact that the Seattle economy will lag the U.S. economy, and have discounted that assumption in their decision-making.

Respondents see little danger of further deterioration in real estate market fundamentals over the near term, and expect cap rates to remain relatively stable, with some moderate upside pressure.

On the other hand, they echo a growing sense of urgency that we must address our many issues or risk limiting our ability to attract capital to support the market. This concern is exacerbated by their recognition that, despite our efforts, the state and region are declining in economic competitiveness.

While one could argue that the respondents' views are not reflective of the broader market and are a knee-jerk reaction to recent events, the reality is that they have remained rather consistent over the past 18 months.

Tackling our problems

Simply stated, these issues are real and will not go away. Rather than joining the ranks of those who merely point out problems, I weigh in on some of the issues to get on the record.

• First, the challenges we face in the Seattle market are real and are not self-correcting. Time will not heal all injuries. While we live in a great region, with many natural amenities and a motivated, educated workforce, we also have a number of latent problems that jeopardize our ability to operate as a vital, livable community.

The list of such issues is long and growing — traffic congestion, unemployment, cost of living, housing affordability — and must be taken on. While its almost a daunting task to figure out where to start, it is important that we focus on the most important elements.

• Second, most of the issues we face are broad regional issues, involving near neighbors to the east, north and south, but perhaps even Portland and Vancouver.

While we should focus on our narrow region over the near-term, we should also consider acting more in concert as the Northwest Corridor, in a manner analogous to the Research Triangle in North Carolina. Such a strategy would help on the bio-tech front, as well as help market the region to outside investors and partners who may be getting mixed signals about our competitiveness.

• Third, we must do a better job of understanding, and then educating ourselves, about the economic implications of the decisions we make. In a number of cases, decisions, actions and inactions are based on the heart, rather than on the bottom line.

While there is need for both perspectives, to arrive at prudent solutions that do not marginalize workers or businesses that are vital to our economic revival, we must do a better job of analyzing the unintended consequences of our actions.

• Fourth, we must recognize that we are in a competitive arena in an increasingly global game in which we must have both defensive and offensive game plans, and the leadership to execute those plans. The urgency behind this is punctuated by our unemployment rates, and the recent trend toward moving white-collar jobs offshore that will continue, and will ripple over into the technology sector that is fundamental to our economic base.

Simply stated, we must start embracing market-based solutions that help us discharge our responsibilities to our core customers — residents, employees and businesses — and ensure that we balance economic viability with livability and sustainability. We must also identify our areas of competitive advantage — schools, knowledge workers, livability — and then invest in them.

• Fifth, we must develop a shared vision for our future, one that is regional in scope and reflects a balance among our various constituencies. While we cannot expect to arrive at a consensus on all our issues (e.g., use of the port, viaduct, light rail and monorail), we must also learn how to compromise, to agree to disagree and then move forward and avoid the temptation to retrace decisions once they have been made.

This discipline and direction depends on a collaborative movement that spans our grass-roots foundation and our leadership. Perhaps even more importantly, it requires that we avoid the temptation to second-guess ourselves, or to step in and try to engineer solutions that cannot be resolved in a public forum.

Recent examples of this are some of the interventions in the development process, where elected officials are beginning to step into the development role. Such efforts have never succeeded, especially in a capital-intensive area like real estate, where there are so many factors to coordinate and where solutions depend on decisive, timely actions and execution.

So, as we move into the New Year, we are once again faced with a number of fundamental issues. The good news is that we are still around to wrestle with these issues and that there appears to be a growing consensus that we should indeed try to get on board the train of economic revival, although we can still decorate our rail car as we see fit.

|

James DeLisle is the Runstad Professor of Real Estate and the director of the Runstad Center for Real Estate Studies at the University of Washington.

Other Stories:

- Insights Program looks at commercial real estate

- Grocery stores cooking up more innovations

- Retail chic: Shopping centers with meeting places

- Development is changing; training should be, too

- When the government takes your property

- Don't get fenced in: Use a land title survey

- Are you paying too much property tax?

- A new corridor may be coming down the Pike

- Columbia City — the next hot spot?

- Yakima Valley real estate heats up

- Town centers rediscovered after years of neglect

- Northwest taps into waterfront properties

- David A. Sabey

- James N. Carbone

- John Solberg

- Mic Dinsmore

- Mark A. Weed

- Portland's economic Rx: a biotech future

- Are hotels overbuilt or just overproposed?

- Tax credit program boosts low-income communities

- Interest rate hike could mean time to sell

- Debt can be good for nonprofits' projects

Copyright ©2009 Seattle Daily Journal and DJC.COM.

Comments? Questions? Contact us.