|

Subscribe / Renew |

|

|

Contact Us |

|

| ► Subscribe to our Free Weekly Newsletter | |

| home | Welcome, sign in or click here to subscribe. | login |

Real Estate

| |

|

December 11, 2014

Good news floods the South Sound market

Jones Lang LaSalle

Boudwin

|

I’m a fisherman. My favorite fish is salmon, which you can catch either in salt or fresh water rivers.

Two years ago I was on the Cowlitz River in southern Washington in the spring, fishing off of my buddy’s river sled for Springers, the spring run of Chinook salmon.

It was a beautiful sunny, crisp day and we didn’t catch one fish. The guides working their own boats kept telling us, “You should have been here yesterday; fish were in.”

Gauging the ebb and flow of the South Puget Sound industrial market sometimes feels the same way. Some days, tenants and investors are all over the market looking for space. Six months later they are either gone or the activity has changed locations — just like the salmon swimming down the river to a different fishing hole.

Demand ebbs and flows

In the first half of 2012, there was a surge of tenants looking for large spaces in our market. They all wanted modern Class A distribution space over 200,000 square feet, also known as big-box buildings. The challenge for all practitioners in the market was that, because of the Great Recession, no new construction had taken place in the preceding four years that wasn’t pre-leased or sold to a user.

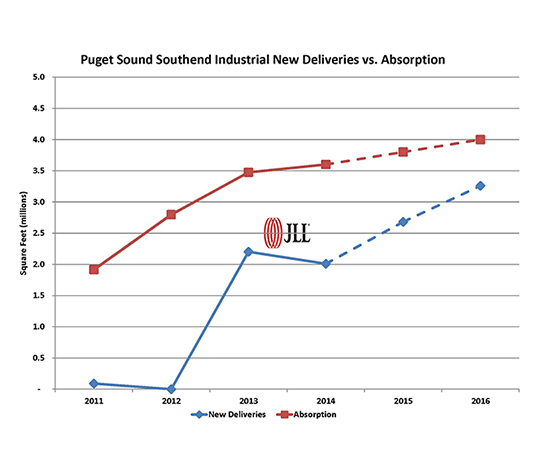

The historical average for industrial new construction is between 2 million and 3 million square feet per year. Between 2009 and 2012, in the entire 213 million-square-foot South Puget Sound industrial market, there was only 1.6 million square feet of industrial space constructed and delivered, of which most was build-to-suit.

There was very little new Class A supply to meet this increased demand. Investors and developers were caught with no lines in the water as the fish came in the river.

But that changed quickly.

Construction of new Class A big-box buildings began in earnest in 2012, with resulting deliveries of 2.2 million square feet in 2013. Because the fish were in the river at just this moment in time, these projects are 89 percent occupied today.

Developers charge in

Developers and their capital partners saw the strength of the Puget Sound economy in 2013, which had significantly better employment growth of 2.8 percent versus 1.7 percent for the U.S. as a whole, according to Blue Chip Economic Indicators. Positive changes continued in 2014 with year-to-date annual changes at 2.7 percent versus 1.8 percent.

Developers and their partners responded to the positive news by pouring investment capital into local industrial markets. The result is another 2 million square feet of new Class A product delivered in 2014. This slate of buildings is 30 percent leased; an impressive number, as the projects were just recently completed.

One thing a fisherman can always count on is the enthusiasm of others when they see you are catching fish.

And so it goes in the industrial market into 2015 and 2016.

We expect an additional 2.68 million square feet of new Class A product to be delivered in 2015 with an estimated 51 percent of the space committed. That’s what one would call “fish in the boat.”

Because of this robust tenant activity, the surge of new product to be delivered in 2016 is estimated at over 3.25 million square feet.

Net absorption

With all this discussion of 2 million to 3 million square feet of new product, one might ask what the demand looks like.

Well, the fish are in the river right now.

In 2011, net absorption, the amount of vacant space absorbed by tenants in the market — or the amount of fish being caught in the river — was reported at 1.6 million square feet. The next year, net absorption grew 75 percent to 2.8 million square feet.

Last year, net absorption grew another 21 percent to 3.4 million square feet, and projections for 2014 are up again to 3.6 million square feet.

If you stand back and look at this South Puget Sound industrial market of 213 million square feet, you will see a 2011-14 total of 4.3 million square feet of new product deliveries overwhelmed by a four-year net absorption of 11.2 million square feet.

No wonder the vacancy rate in this market has dropped from 7.4 percent at the beginning of 2011 to 4.2 percent today.

No wonder investors and developers are planning to build an additional 5.9 million square feet in 2015 and 2016, with an additional 12.9 million square feet proposed.

Investment sales

For the fisherman, a series of rainy days following a dry spell can mean the fish come roaring up stream.

The dry spell for the world economy began in late 2008. But just like the positive changes in water flow in a river after a big rain, the economy healed and investors came roaring back.

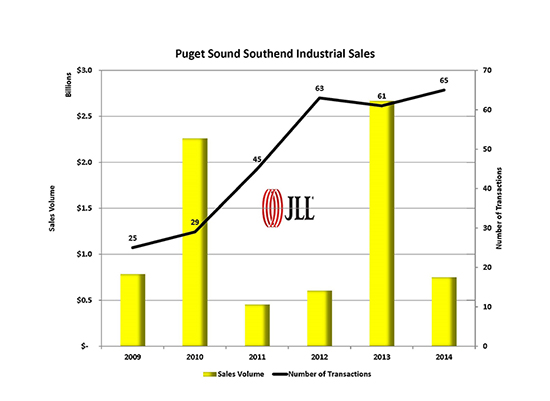

The number of industrial sales transactions in the South Puget Sound market increased from 25 in 2009 to 45 in 2011 to 65 this year as of November. Dollar volume jumped in two of those six years: $2.2 billion in 2010 and $2.6 billion in 2013, while remaining below $800 million the rest of the time.

The industrial real estate report for 2014 is excellent. Coincidently, the salmon season report for Washington coastal and Puget Sound waterways this year was also excellent.

A good day of fishing feels just like this busy market does right now. Fish on!

Leslie R. Boudwin, SIOR, is managing director at Jones Lang LaSalle in Bellevue.

Other Stories:

- Relax; the lodging market looks strong

- Survey -- Mack Urban

- Survey -- Daniels Real Estate

- Survey -- Harsch Investment Properties

- Survey -- Vulcan Real Estate

- Survey -- Capitol Hill Housing

- Survey -- Seco Development

- Sustainable workplace? Yes, but what about design?

- Don’t get rattled by earthquake insurance changes

- Become a big-shot developer with crowdfunding

- The ‘100 percent corner’ moves downtown

- Here come more apartments; now what?

- Office market tightens as tech companies expand

- Survey -- Skanska USA Commercial Development