Surveys

Awards

DJC.COM

March 24, 2005

Super steel rebar coming to the Northwest?

Special to the Journal

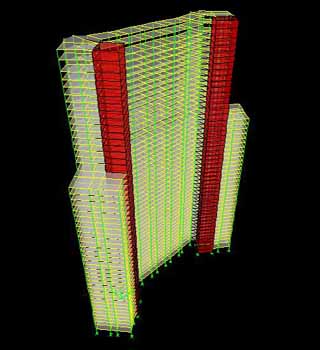

Image courtesy Cary Kopczynski & Co.

Two cores of this planned Las Vegas building will use rebar with a 100,000-psi yield strength. Foundations will also use the high-strength steel.

|

Even in Las Vegas — a city known for its extravagance and excess — developers are eager to take advantage of building products designed to cut construction costs, especially since the price of steel has doubled in the past year.

So when Bellevue-based structural engineer Cary Kopczynski & Co. suggested using a stronger type of steel reinforcing bar in areas of a $300 million, 1.25 million-square-foot condominium tower set to break ground this spring west of the Strip, the owners were all ears.

"The single biggest reason we're using the steel is the financial impact," said Marco Sakamoto, senior project manager with CM&D of Las Vegas, the construction manager for owner Orlando's Del American Properties. "It's also good for the owner because it's a value engineering method that doesn't touch the finishes — things that the buyer would see. That's another big part of why we're going that way."

Developed by Charlotte, N.C.-based MMFX Steel Corp. of America, the stronger rebar — called MMFX 2 Microcomposite Steel — offers a breaking strength of nearly double conventional 60 grade rebar. Its yield strength — the point at which steel permanently deforms under load — is nearly 70 percent higher than its weaker counterpart.

The steel's stronger properties mean considerably less steel is required, lowering the project's cost substantially.

Cary Kopczynski, president of the Bellevue engineering firm, estimates that of approximately 6,000 tons of conventional rebar in the Las Vegas tower, the use of the stronger steel in the foundations and shear walls will eliminate in excess of 1,000 tons of rebar, resulting in substantial cost savings. Construction on the 51-story tower is scheduled to start in late spring.

MMFX 2 steel isn't new, but its use in high-rise structures is. It was originally marketed for its corrosion-resistant properties and has been used for years by state transportation departments in bridge construction and on projects whose foundations are in wet soil.

Kopczynski's firm specified the steel for its corrosion resistance in the foundation of the new Kitsap County Convention Center in Bremerton; a project with a basement parking level located just above the saltwater level. A proprietary steel microstructure that is formed during the production process raises the steel's corrosion threshold to five or six times above original grade 60 steel and eliminates the need for a protective epoxy coating that can chip off. That same process also gives the steel its increased strength.

Price prompts innovation

The escalating price of steel — 80 to 100 percent, according to some estimates — has left the U.S. construction industry scrambling for relief. Most economists blame China and its booming economy for our steel woes. As China's economy grows from poverty to lower-middle-class, the country is buying more cars, building more infrastructure, and doing more business.

China's steel consumption is up 110 percent over a 6-year period and is rising, according to the Web site of Global Insight, a Washington, D.C., economic consulting firm. The raw materials and finished steel that were typically exported to the United States a few years ago are now being used up by the Chinese, leaving the U.S. with less steel and higher prices.

China isn't the only country competing for steel and its components. Japan, India and other smaller economies are also posting favorable growth rates.

The price jump has sent owners, designers and builders on a search for ways to slow construction costs.

"As structural engineers, we deal with steel all day long," said Kopczynski. "We're always looking for ways to build a better mousetrap."

MMFX 2 may be the tool the industry is looking for. The steel's stronger properties mean less product is required, resulting in lower labor costs and reduced construction time, said Roger Stutzman, MMFX Steel's northwest regional sales manager.

Passing the test

MMFX 2 steel was recently approved by the American Society for Testing and Materials to be used as a 100,000-psi product, legitimizing its use in the industry. However, because the stronger steel is relatively new to the market, its use as a high-strength product is not yet appropriate for all applications, Kopczynski said. Its behavior when it reaches its yield point is inconsistent with that of common rebar, he said, requiring further study to define its characteristics and appropriately design for its use.

MMFX 2's use in seismic zones such as California or the Pacific Northwest is limited mainly to foundation mats where seismic movement isn't an issue, Kopczynski said. Groups such as the American Concrete Institute's Committee 318, on which Kopczynski sits, continue to study the steel's properties so it can eventually be used in high-rise applications along the West Coast.

In the meantime, buildings like the 51-story Las Vegas condominium, which is in a low seismic zone, are ideal candidates for the new rebar. The product is also being used in the shear walls of a 31-story high-rise condominium tower in Aventura, Fla., just north of Miami.

Sheila Bacon is a freelance writer covering Northwest architecture, engineering and construction.

Other Stories:

- Construction training program boosts Rainier Valley

- Try mediation on that next construction dispute

- Piers, wharves could be the next quake victims

- Is a GC/CM responsible for design defects?

- New tools for fighting jobsite theft

- Who's most at risk in road construction?

- Tax breaks coming for contractors, design firms

- Finding closure on building enclosures

- Unique deck system speeds up Lincoln Square

- 5 trends that will reshape mechanical contracting

- Construction 'right to cure' statute full of pitfalls

Copyright ©2009 Seattle Daily Journal and DJC.COM.

Comments? Questions? Contact us.