Surveys

DJC.COM

December 9, 2004

Downtown Seattle office market: Is less worth more?

Re•Solve

Gibbons

|

While the leasing market can be described as soft or unstabilized, with rents well below economically feasible levels, we are experiencing some of the highest prices ever paid for mid- and high-rise office properties.

Why?

Are investors betting on a resumption of stabilized occupancy and significant rental gains in the near term to support their pricing models? Or is this an interest-rate bubble for which we may eventually experience a market correction?

The answer to both these questions is — in somewhat oxymoronic fashion — "Yes."

Recovering market

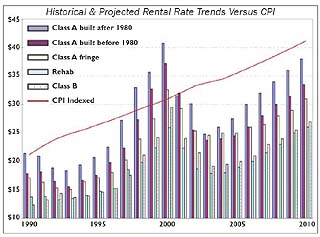

Chart courtesy Re•Solve

Seattle CBD office rental rates are expected to continue to rise for the next six years. Click here for a larger view.

|

There is little doubt that the rental market is in a recovery phase, although this is not easily found in this year's numbers.

We are updating our early 2004 survey of the CBD proper, in which we reported an average 14.9 percent vacancy. While the survey is far from complete, our initial research suggests we may see a small increase in vacancy this year-end over last, but not enough to suggest a further market decline. Brokerage surveys indicate similar results.

Rents, which have been on the decline since 2000, have flattened out and did not markedly change in 2004. None of this sounds particularly good, but it isn't bad news, either.

Employment growth — which is the most important determinant of real estate occupancy, be it apartments or offices — is slowly but surely chewing up the exceptional job losses that we sustained in the 2001 recession. Next year's job growth is expected to surpass this year's, likely resulting in some real gains in occupancy and rental rates by the end of 2005.

Market recovery timing

If predicted employment gains prove out, our forecast model, which is based on the historical relationship between occupancy and CBD employment, suggests we will be seeing vacancy rates in the low teens by the end of 2005 and into 2006, with near-stabilized conditions around mid-year 2006.

As luck would have it, that is pretty close to the planned delivery of Washington Mutual Center, which will single-handedly deliver the largest supply of CBD space into the urban core since the completion of three towers in 2001-02. While the 1.1 million-square-foot WaMu Center and Seattle Art Museum addition will be 100 percent occupied by WaMu, all of that occupancy will come from existing leased space within the CBD.

We anticipate the market will be able to fill this void within a two-year period, but the delivery of the tower may set the office market back by 18 months or so.

Allowing for some additional product in conjunction with the delivery of the tower suggests that it will be 2009 or 2010 before we experience a resumption in stabilized occupancy, around 90 percent. And that is good news, calling for five or so years of strong positive net absorption, with the expectation that between now and 2010, the market will have accommodated the addition of some 3.5 million square feet of office space within the CBD.

Rental rate growth

Experience tells us that when a market recovery hits, rental rate increases can be spectacular. By the same token, the re-emergence of a market where new construction is economically feasible can be spectacularly short, largely on account of the nature of the business cycle, but also due to parallel development.

It is taken for granted — especially for high-rise real estate which takes years to develop — that the economic conditions that precipitate new development are often markedly different than those at the time of product delivery. This makes it difficult to plan projects to appear when they are really needed, and even more difficult to stop their delivery from occurring in times when they are not.

Lincoln Square and Bellevue Technology Tower are examples of the fallout associated with being on the wrong side of the curve.

So just where are investors projecting rental rates will be in the next few years?

By most projections, resumption in stabilized conditions won't be a quick turn-around. However, recognizing that rents will rise as conditions become more favorable, most investors are expecting significant gains in rental rates in the latter half of this decade. Our own modeling calls for increases on the order of 50 percent or so over the next six years — once again allowing the Class A space average to come close to $40 per square foot.

Bubble bath?

It would be nice if at least one article on real estate would not mention the now overly familiar phrases of "low-interest rates" and a "bubble effect," but this is not going to be it.

Interest rates have allowed investors to get more bang for that rental buck than has been the case in the 20-some years I have been monitoring investment performance. We all know what is going to happen when interest rates rise — the investor feeding frenzy of late will turn into a delicate hors d'oeuvres party.

But what will happen to rental rates? There may be some good news here for the bulk of those owners who have no interest in selling or further leveraging their real estate. While investors out there have been bidding up the price of strategic (and even non-strategic) real estate, the gains for most existing property owners have been paper gains at best.

Less noticeable is that lower interest rates have substantially lowered the economic barrier to new product entry. That is sobering news in a real estate market where new supply has historically had a fairly devastating impact on income and occupancy performance in existing product.

By my calculation, low interest rates have produced potentially as much, and arguably more than a 20 percent increase in the value of investment product — with no corresponding improvement in income performance.

As interest rates rise, though, the development feasibility equation becomes more dependent on improving income performance, and less on spectacularly low investment returns. We should call that a return to fundamentals.

In addition, higher rental gains will help cushion any value "loss" associated with a a higher interest rate environment. So we should avoid any bubble-busting impacts.

If the bad news is that interest rates may be rising, the good news is that we should at least begin to see some decent rental rate gains in the not too distant future. Most market analysts would be much more comfortable with a return to investment conditions whereby the health of the rental market becomes the predominant driver of value. And those times are likely on their way.

Anthony Gibbons, MAI, CRE, is principal of the real estate appraisal, counseling and mediation firm of RE•SOLVE. He has been analyzing real estate markets and values in the Puget Sound area since 1983.

Other Stories:

- CBA's Insights program turns eight years old

- Soggy building? Better check your insurance

- Real estate's important role in mass transit

- Sleepy Spokane awakes to a real estate renaissance

- Let's go downtown — Bellevue, that is

- Seattle's goal: create community, not crowds

- How mixed-use can save commercial districts

- Low-income housing goes green

- Seattle's land code needs a diet

- Does your landlord have too much control?

- Alderwood gets urbanized and upscaled

- For Eastsiders, it's been the best recession ever

- Owners' reps keep a lid on project costs

- Eli Khouri

- Patrick Callahan

- Matthew J. Griffin

- Don Milliken

- Frank Stagen

- Seattle's waterfront can be an amenity for the region

Copyright ©2009 Seattle Daily Journal and DJC.COM.

Comments? Questions? Contact us.