Surveys

DJC.COM

December 10, 2009

A lean, mean, clean and green future

University of Washington

DeLisle

|

It is a widely known fact that real estate is a cyclical industry, experiencing periods of growth followed by periods of contraction. During my 40-year career, I have survived several of the more dramatic real estate cycles. So, as we head into the current downturn, I have a sense of déjà vu, a feeling that it indeed is a case of “back to the future” once again.

As such, I jumped at the opportunity to dust off my crystal ball to talk about what I think the industry will look like when it recovers from the recent cyclical downturn and what it means to those of us in the profession.

Before we talk about the future state of the industry, I should point out from the get-go that I do not believe this is a typical “cyclical phase” but a structural change that will create something of a revolution in the industry.

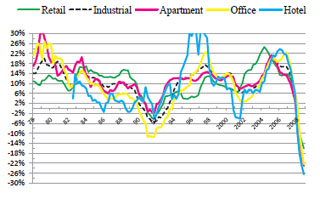

Leaner

The commercial market is in the midst of a collapse in value that is unprecedented in terms of its speed and depth. In addition, the collapse in values is noteworthy in that it has cut across all property types and most markets.

Many are hoping the “correction” in values will be just as fast and pronounced as the collapse. Indeed, some have found solace in the fact that the current cyclical correction wasn’t the result of overbuilding, suggesting the recovery will be quicker than it was in the past. Unfortunately, the excess capacity caused by the recession will lead to even higher vacancy rates.

While the spatial markets will ultimately recover, the capital side of the equation will not return to its previous state. That is, the bubble pricing due to the influx of excess capital that we experienced will not be “cured.” Thus, values will not recover to their record levels, but will gradually return to values supported by long-term cap rates which average around 8 percent rather than the sub 6 percent during the recent heyday.

I refer to this phenomenon as de-capitalization with returns more in line with long-term averages. As such, market timers looking for “no-brainer” investing — which is predicated on rising prices rather than value creation and experience — will be left holding the bag.

In terms of timing, I believe we are in for a prolonged period of market malaise. Furthermore, we haven’t reached the bottom despite record losses in value. So, the first order of business for those in the industry is survival.

Unfortunately, not all will be able to survive and others may opt not to even try. Thus, we are likely to see our industry go through another wave of contraction. This will occur at both ends of the spectrum, with some of the newer players forced to turn to other careers and some of the more established players opting to retire and cash out rather than risking their fortunes in the new regime.

At the same time, there will be a number of consolidations and strategic acquisitions including a wave of offshore investors. The end result will be a leaner industry.

Meaner

Even those who survive the downturn will find the “rules of engagement” have dramatically changed. Conducting business will be much more difficult and risky than in the recent years where the market depended on cheap, easy, plentiful credit. Going forward, developers and investors will have to satisfy rigorous underwriting requirements, ante up real equity positions, and accept recourse liability exposure. This will force them to place greater emphasis on risk management and the fundamentals of supply and demand rather than capital market appetites for investment products.

While some players will hold out for a return to the recent past, that is simply not on the horizon, at least until institutional memories fade once again. In the meantime, the industry will be facing a period of “de-capitalization” which will exacerbate the current situation and place upward pressure on cap rates. That is, allocations to the asset class will be reduced and yield hurdles increased as investors and lenders focus on the risk side of the proposition. At the same time, deterioration in market fundamentals will create additional downward pressure on real estate values.

The end result will be an asset class which will lag other asset classes. This will force many investors to revisit their commitments to real estate. It will also create an opportunity for asset takeovers as frustrated investors fire managers who got them into troubled investments. Lenders will also be forced to play hardball, moving more quickly on troubled loans in an attempt to control their own destiny. Thus, we can anticipate operating in both a leaner and meaner industry, with little tolerance for mistakes. As a fundamentalist, I believe this will be healthy in the long term, but extremely painful in the short term.

Cleaner

I recognize there is a lot of capital sitting on the sidelines, waiting for the right moment to swoop in and pick up the pieces much like the vulture funds of the mid-1990s. Some observers argue the influx of opportunistic investors will stabilize values and jump-start the industry.

Granted, a number of new entities and funds have been established to help place this capital. While this “matchmaker” role is important, advisors will face challenges capturing high returns, with their only course of action being the acceptance of commensurate levels of risk.

Furthermore, the underlying sources of this “opportunistic” capital are not the extreme risk takers that it takes to play the market-timing game and strike before a clear bottom has been reached. Rather, most of the money is from more moderate risk takers who will wait for signs that the bottom has been reached before dipping their toe in the pool and risk getting their legs torn off. This has been evidenced by the fact that the few “good” properties that have come to market have been met with strong demand and received multiple bids.

In the Puget Sound Region, this will create an opportunity for re-capitalization, with local players being able to repurchase assets clouded by temporary impairment that were sold at the peak of the market. So, for the next several years, at least, we are looking at an industry that will be leaner, meaner and focused on cleaner assets.

Greener

Finally, the real estate industry has been experimenting with a lot of innovations as it sought out new niches. This translated to a wave of green buildings and experimentation with new products (such as mixed-use and lifestyle centers) and locations (such as urban infill and transit-oriented development).

While desirable in the long run if the fundamentals are right and there is sufficient demand, these trends will be slowed down by the decline in construction activity and industry contraction. At the same time, renewed emphasis on risk management will favor products and locations with proven track records rather than new speculative projects which may be ahead of their time. This change will require tremendous discipline and depend on greater cooperation from planners, politicians, regulators and other parties who have come to expect a lot from developers.

While developers will always innovate and rise to the challenge, in the new regime they will do so only when the promise of economic rewards offsets the risks. Thus, the industry will be leaner, meaner, cleaner and greener; albeit green being infused with the promise of economic benefits. That determination will depend on rigorous research and analytics; that’s where the academic side comes into play.

Jim DeLisle is the director of Graduate Real Estate Studies and the Runstad Professor of Real Estate at the University of Washington. He earned his doctorate in real estate from the University of Wisconsin. He has more than 35 years of experience in real estate, with his time split between stints as an academic and a real estate professional. Real estate-related information can be found on his Web site, http://jrdelisle.com.

Other Stories:

- ‘Game changers’ show what’s ahead for commercial real estate

- Need a loan? Here’s what you should know

- Are you prepared for the big flood?

- Aigner finds calm after near-death experience

- 10 things I learned in Green Broker school

- Pioneer Square gets ready for change

- New office towers help CBD move north

- Sumner’s industrial market weathers the economic storm

- Retail’s bumpy ride starts to smooth out

- Is the recession for hotels ready to end?

- Further pain coming in the multifamily markets

- Bellevue’s office market more ‘fit’ than Seattle’s

- Relax; it’s only a business cycle

- Dean C. Allen

- William Pollard

- Chris Pratley

- Why the economic loss rule matters

Copyright ©2009 Seattle Daily Journal and DJC.COM.

Comments? Questions? Contact us.