|

| |

![[Commercial Marketplace]](commark.gif)

|

|

| |

![[Commercial Marketplace]](commark.gif)

|

BY DALE SPERLING

The Norman Company

After a national real estate convention not long ago, I found myself engaged in a conversation with a crafty, seasoned real estate professional from Seattle. Small talk quickly changed to shop talk, and he soon asked me for my take on the market.

"Hey, it's great," I told him. "Last year's absorption downtown was 650,000 square feet, and eight out of nine submarkets we survey are now greater than 90 percent occupied."

"Who really cares about historical absorption?" he said. "Let's talk about what's going to happen in the future!"

I found myself agreeing. Too many of us real estate folks fall into that trap. We evaluate the market's recent past and try to project the future based on looking in the rearview mirror.

But what does that really tell us about the future? Can it help us determine where the market will go, or how we can best assist our clients in their real estate needs?

In a word, no.

We shouldn't be talking about last year's numbers or last quarter's. Our focus should be on the prospect for job growth, because it is joined at the hip with the future of the commercial real estate market.

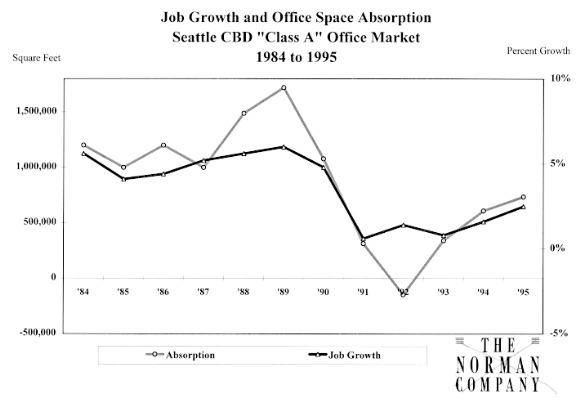

Downtown absorption tracked against job growth for the region from 1984 through 1996 reveals that a very strong relationship exists between job growth and absorption. There were two notable periods of discontinuity: 1989-1990 when the region was trying to absorb more than four million square feet of new construction put on the market, and 1991 which coincided with the hangover from the previous binge, as well as the surplus produced by the Bank of America and Security Pacific merger.

Job growth and office space absorption of Seattle Class A office space from 1984 to 1995.

In the five years from 1984 to 1989, when local and national economies were firing on all cylinders, job growth in our region zoomed along at five or six percent annually, or about twice the national average. In the Puget Sound region, we were adding between 50,000 to 60,000 jobs per year. Guess what? That created a very forgiving environment for commercial real estate.

The rule of thumb was simple: slap something up, and you'll make money at it. But that environment changed in the early 1990s, as national and local economies cooled dramatically.

Locally, the economy slowed significantly as aerospace orders tailed off and Boeing began to "right-size" on a massive scale. Nevertheless, our region's job growth rate continued to be positive, although very much slowed by historical standards.

From 1991 to 1995, the Puget Sound region experienced its slowest growth rate for any five year period since World War II, even slower than the Boeing crunch of 1970-75. But, the growth rate never went negative and, for the five-year period, it was still higher than the national economy.

While Boeing lost 40,000 jobs and another 60,000 Boeing-related jobs disappeared, the Puget Sound economy still maintained positive job growth. That, in any historical context, is remarkable. All other Boeing downturns resulted in a severe local recession and overall job losses. This most recent Boeing setback had a less severe impact, because the loss in jobs has been spread out over a longer period and many of these jobs have been given up due to retirement rather than layoffs.

Additionally, the region has diversified its industrial base and no longer relies on one company to fuel its economic engine. For example, Puget Sound, on a per capita basis, has four times the national average in trade related to international commerce. And, there is the well known growth in the biotech and software industries.

So, it seems that job growth in the Puget Sound region is inevitable.

As our region's job situation continues to shift and settle out, the commercial real estate market is approaching a critical point. The 22-million-square-foot downtown market, which was never in danger of being severely over built, now appears to be running short on space. The greater Seattle market has a vacancy rate of less than 10 percent -- 7.8 percent as of December 31, 1995 -- and no new supply has come on-line since Second and Seneca in the spring of 1991.

The niche most affected by this tightening market is contiguous space. In a 12-month period from December 1994 through December 1995, the market went from eight buildings with more than 30,000 square feet of contiguous space to only three buildings with that kind of space available. As of December 1995, there was nothing in the downtown market that could accommodate a tenant with needs of 50,000 square foot.

Does this mean we are about to see new construction downtown?

Emphatically, no. Don't expect this to change until the economic rent gap narrows. The current rates of $20 to $22 per square foot would have to climb more than $10 per square foot to justify a new office building.

With office absorption in lock-step with job growth, what does all this mean for the future of our region's office market? Simply this: if there is two percent or greater job growth in the next two years -- and it seems highly likely that that will occur given the state of affairs at Boeing and the strength of the economy in other areas -- then something will have to give in the office market.

If you propose two percent job growth for the next year or two, you get real tight, real fast. Vacancy gets down below five to six percent in 18 to 24 months even if some new supply could be added. Given the lead time for new supply, that is not likely. Something's got to give.

Among the scenarios:

Office worker densities will increase, possibly from 220 square feet per employee to 150 to 180 square feet. Tele-commuting will increase. People working at home and sharing desk space, as well as other resources at the office may become more a part of our professional environment. Companies will locate elsewhere to perhaps lower cost suburban locations.

And finally, rents will increase. Hold on to your hats. It could be quite a ride for the next several years.

Dale S. Sperling directs The Norman Company's Advisory Services Group, which includes Corporate Real Estate Services and Investment Sales & Acquisitions. The Norman Company provides real estate services for real estate users and investors.

Return to Commercial Marketplace top page

Return to Commercial Marketplace top page