Surveys

DJC.COM

December 14, 2006

Seattle’s simmering office market about to boil

Vulcan Inc.

Mason Curran

|

My colleagues at Vulcan Inc. asked me last May what was in store for the downtown Seattle office market as we moved into the latter half of 2006. I boldly stated that we should expect rental rate growth in double digits, vacancy rates dropping below 10 percent, a record transaction price and over 1 million square feet of positive net absorption. The result would be the ground breaking of a speculative office building in downtown Seattle.

So, how did I do? By my own account, five for five:

• Double digit rent growth? Check. CB Richard Ellis reports average Class A office asking rates of $26.75 a square foot as of the third quarter of 2006, up 12 percent over the same period in 2005.

• Vacancy below 10 percent? Check. As of Dec. 1, CoStar shows downtown Seattle office vacancy at 9.6 percent, just below double-digit territory.

• Record office transaction price? Last September’s transaction of Civica Office Commons for $575 a square foot wowed the local real estate community; OK, so it isn’t in downtown Seattle but Bellevue is part of the greater local market; alternatively, the 9th & Stewart Life Sciences Building transacted for $504 a square foot in October. Technically not an office building? Well, surely you get my point — capital is flowing into the local office market and Class A properties are commanding top dollar. Besides, I’m going for five for five here. Check.

• Over 1 million square feet of absorption? Check. The first three quarters of 2006 alone saw 1.5 million square feet of net absorption; we would have to lose over 500,000 square feet in the fourth quarter for me to get this one wrong.

• Ground breaking of a speculative office building? Check. In November, Vulcan Inc. broke ground on the Seattle’s first large speculative office building in this cycle, the 300,000-square-foot 2201 Westlake project (OK, so maybe I had a little inside info here).

While I would like to claim some special insight, my prediction followed a basic economic recipe; and if you were paying attention, you likely saw it coming, too. The local market is well supplied with the key ingredients and it’s time for developers to start cooking.

One word of caution though, appetites can be unpredictably and rapidly satisfied, so overproduction is always a potential risk. Unlike holiday dinners, leftovers are not appreciated and those partaking in the feast are very unlikely to overeat and certainly won’t fill their plates with more than they can comfortably absorb.

Recipe for speculative offices

Job growth

The Seattle metropolitan statistical area (MSA) gained almost 63,000 jobs in the first 10 months of this year, nearly 50 percent more than the total gained in all of 2005.

Local economist Dick Conway forecasts 2006 Puget Sound job growth of 3.8 percent by year-end and continued growth close to 2.5 percent annually through 2008, more than double the forecasted growth rate for the nation.

Employment is well above pre-recession figures and many of the area’s top employers are expanding. Most notably, over the next two years Boeing is projected to add 15,000 jobs and Microsoft is planning a campus expansion that could house as many as 12,000 employees. Growth in these primary industries will ripple through the economy, adding more jobs and creating the need for additional office space.

Further, five of Seattle’s top 20 employers have committed heavily to downtown Seattle office space this year — offices that will house thousands of employees.

• Washington Mutual moved into its newly constructed 890,000-square-foot WaMu Center.

• Safeco leased a combined 424,000 square feet at 1001 Fourth Avenue Plaza and 2nd & Seneca.

• Starbucks purchased a 200,000-square-foot Pioneer Square office building with adjacent development potential for another 200,000 square feet of office space.

• Group Health pre-leased 180,000 square feet in Vulcan Inc.’s Westlake/Terry building under construction in South Lake Union.

• The University of Washington is constructing 98,000 square feet of office space and 170,000 square feet of laboratory space in two buildings in South Lake Union.

Low unemployment rate

| Conceptual and pending projects: |

|

• 83 King Street expansion (127,500 square feet) • 100 NE Northlake (24,200) • 220 Elliott Avenue West (75,000) • 505 First Avenue South (204,000) • 635 Elliott Avenue West (330,000) • 2121 Sixth Avenue (200,000) • Boren & Howell Life Sciences Building (220,000) • Center of Pioneer Square (190,000) • Metropolitan Tract redevelopment (455,000) • Quadrant Lake Union-Lake View (100,000) • United Methodist Church site (size to be determined) |

Of the nation’s top 10 MSAs, Seattle experienced the greatest drop in unemployment between the peak of the recession in mid-2003 (7.3 percent) and the first quarter of 2006 (4.5 percent), plunging a respectable 280 basis points. Today, Seattle’s unemployment rate is just 4.0 percent.

Growing net migration

In 2002-03, the Seattle MSA lost 5,200 residents as the economy went into a recession. We gained 17,300 in the following two years and now we are facing a dramatic surge to an average of 25,000 residents annually over the course of the next five years, approaching levels that have not been experienced since the late 1990s. No, it isn’t the weather that’s drawing them here; it’s the promise of jobs, plenty of them, jobs that will create the need for more office space.

Fewer large contiguous tenant spaces

Since the first quarter of 2006, the number of available Class A spaces over 150,000 square feet has diminished from four spaces to zero. Currently there are only two contiguous spaces over 100,000 square feet and only six buildings can meet a 50,000-square-foot requirement, enough for about 200 workers.

Lack of significant new supply

Downtown Seattle’s inventory of Class A office buildings (excluding new construction for owner occupancy) has remained stable at about 35 million square feet for several years. But don’t expect this to last. Both new and expanding tenants looking to fulfill near- to medium-term space needs (and they are out there) will have limited options until new supply comes on line. Fervent job growth and robust leasing activity have fueled proposals for new office development and many developers are ready to start building.

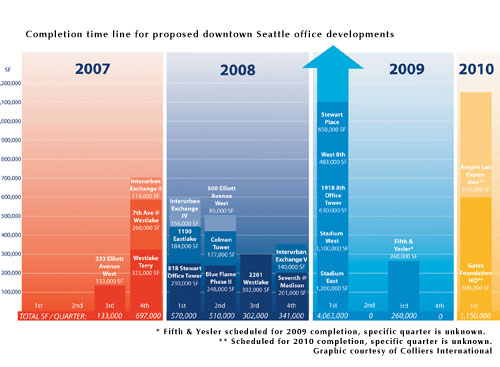

More than 4 million square feet of office space is proposed for the downtown Seattle market. But only about half of this is far enough through permitting to break ground next year. Touchstone, Schnitzer Northwest and Clise Properties have master use permits (MUPs) for a combined 1.65 million square feet of office space in the Denny Triangle and Martin Selig has a MUP for a new building in the south part of the financial core. So, at this point, it appears to be a question not of when or where the next office will be erected, but rather which developer will take the plunge.

What’s in store for 2007?

Seattle office demand drivers are healthy and getting stronger. As we move into 2007, expect continued rental rate growth in double digits, further declines in vacancy, more ground breaking and yes, a large pre-lease at one of the speculative office buildings.

Conditions have aligned to ensure a robust office market for several years. But, let’s watch the pot closely because contrary to the old adage that a watched pot never boils, eventually it will boil over.

Lori Mason Curran, MAI, CRE, has more than 15 years of experience valuing and researching commercial real estate. As real estate market research manager, she is responsible for the research, valuation and investment functions for Vulcan’s various real estate departments.

Other Stories:

- Despite residential setbacks, commercial market is strong

- UW to offer master’s degree in real estate

- 8 experts take a look at real estate’s future

- Insurance costs will likely continue their post-Katrina climb

- Bellevue: What a difference a decade makes

- Couple builds a legacy in the U District

- Buyers line up to get south end industrial land

- Tri-county apartment market is hot

- The time’s right to build offices near Lake Union

- High-rises open the door to high design

- Robert J. Tindall

- Anthony Downs

- Linda Berman

- Do you have what it takes to get into real estate?

Copyright ©2009 Seattle Daily Journal and DJC.COM.

Comments? Questions? Contact us.