Surveys

DJC.COM

December 10, 2009

Further pain coming in the multifamily markets

Gardner Economics LLC

Gardner

|

When I was asked to provide my views relative to the current condition of our multifamily real estate market and my prognostications for 2010, I felt somewhat like the Grim Reaper. This has, indeed, been another very trying year in the residential markets across the U.S. and, in Seattle, we have certainly not been isolated from the financial crisis that occurred in 2008.

Troubling apartment supply

Looking firstly at the apartment market, I remember writing an article for the Daily Journal of Commerce in late 2007 (“Now is the time for apartments, but beware!”) that questioned the rationale for the number of apartment units that were scheduled for market entry in 2008 and 2009. In as much as virtually nobody saw the looming economic tsunami that was to occur with the meltdown of the financial markets, my concerns back then lay with the potential for over delivery of units this year and next, as well as expectations as to achievable rents. My prognostications were, unfortunately, correct.

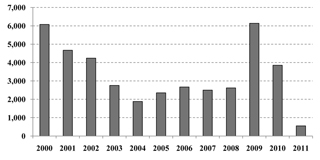

Data that I obtained from Dupre + Scott suggests that we will deliver 6,137 new units to the tri-county market this year, which will be followed by an additional 3,855 units in 2010. If there is one positive number to be found, it is that, thankfully, we should deliver just 552 units in 2011.

To put this in perspective, this year we will introduce slightly more units to the market than we did back in the bull market of 2000. Additionally, we will likely continue to introduce additional units in the form of failed condominiums that will further fatten the supply to an already saturated market.

Such additional product, when placed in concert with low job growth prospects, do not bode well in the short term. As such, I expect that we will see further rent reductions as landlords continue to compete not only against their peer group, but also with the for-sale market as affordability levels continue to rise.

From a transactional standpoint, although not prevalent in our marketplace yet, private demand for distressed apartment projects in parts of California is far higher than I would have expected. Buyers appear to be highly motivated to transact, due in large part to a favorable spread between cap rates and interest rates. This tells me that private buyers, although cognizant of the current depressed marketplace, are looking at demand further out and believe that a recovery will see asset appreciation in the mid-term. This is a trend that may well be headed our way in 2010.

My final thought relative to apartments may be a little counter-intuitive but worthy of consideration all the same. With very little in the way of new condominium construction after the current wave of new supply is delivered, I do see the potential for a lack of product to meet anticipated demand that could occur in 2011 and 2012. Given current financing restrictions, that I will discuss below, in concert with stubbornly high labor costs, I think that we may see conversions spring back to the marketplace to take advantage of demand further down the road.

In as much as we may provide new condominium stock in later years, if this does not occur, who will be there to take up the potential slack in the mid-term?

Condos yet to bottom out?

Turning my attention to condominiums, this has been a very tough year with multiple projects heading either to the auction block or being offered as apartments, further exacerbating the rental market woes discussed above.

It is clear that the reset button has been firmly pushed relative to price, and I do not expect that we will see the return of the heady values that we had been anticipating achieving back in 2006 and 2007. Prices that were, for the better part, pushed higher through increasing hard costs as well as “fake” demand, have started to retrench, and I still question whether a bottom in our market has yet been reached.

It is my opinion that, in as much as I see the foundations forming for a bottom in our single-family housing market, condominiums will see further price erosion before they start to stabilize. Price expectations are still uncomfortably high, specifically in our high-rise projects. When one factors in the availability and cost of non-conforming finance vehicles, as well as the ability to sell existing homes in order to purchase, I believe that sales velocities and price will continue to be negatively impacted, specifically at the higher price points.

There are, however, signs of stability and even an uptick in transactional velocity in many of the more affordable mid-rise projects across our region. This is encouraging, and discussions with brokers suggest that, when appropriately priced, units are trading. The key words, however, are “appropriately priced.”

Looking to the future, it is clear that the makeup of the capital stack has changed forever. Cautious underwriting from financial institutions will lead to a larger component of private money required to get a project out of the ground, and this capital, although available, will come at a premium. Non-recourse financing, for the better part, is also a thing of the past and that will further impact future development prospects.

To conclude, I have always been a fan of denser development in our region and I stand by my opinion that, due to our ever changing demographics in concert with growth management policies, there will be demand for multifamily product in the long-term.

The last few years have been hard on multifamily developers and I expect that there will be further pain to endure as we go into 2010. If there is a bright spot on the horizon, though, we should start to see job creation by early summer and I anticipate that this growth will stimulate the need for additional multifamily products once we exhaust the current supply. The big question that remains is how long it will take to work through our existing inventory.

Matthew Gardner is a principal in the land-use economics firm of Gardner Economics LLC in Seattle.

Other Stories:

- ‘Game changers’ show what’s ahead for commercial real estate

- Need a loan? Here’s what you should know

- Are you prepared for the big flood?

- Aigner finds calm after near-death experience

- 10 things I learned in Green Broker school

- A lean, mean, clean and green future

- Pioneer Square gets ready for change

- New office towers help CBD move north

- Sumner’s industrial market weathers the economic storm

- Retail’s bumpy ride starts to smooth out

- Is the recession for hotels ready to end?

- Bellevue’s office market more ‘fit’ than Seattle’s

- Relax; it’s only a business cycle

- Dean C. Allen

- William Pollard

- Chris Pratley

- Why the economic loss rule matters

Copyright ©2009 Seattle Daily Journal and DJC.COM.

Comments? Questions? Contact us.