Marketplace

Surveys

DJC.COM

February 22, 2001

Land is still hot but sales pace cooling

Kidder, Mathews & Segner

- One factor that could influence how developers view downtown land is the ‘super bonus’ program being proposed by the Seattle Office of Housing. Some downtown areas could receive a 30 percent height increase for developers who buy transferable development rights (TDRs).

The appetite for development land in downtown Seattle remains strong, leading to substantial increases in property values since the “dark days” of Seattle’s real estate market in the early 1990s. Land values, however, are likely to stabilize as the market catches up to the frenzy of new development — both office and residential — that has occurred in and around the downtown Seattle core.

|

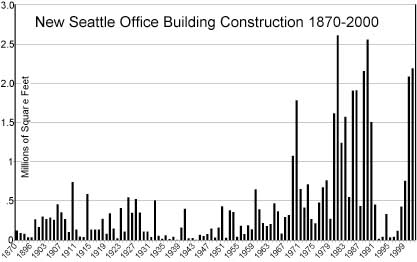

Demand for commercial land is directly tied to development feasibility. In the early 1990s, the best office space could be leased for under $20 per square foot in a substantially over-built market. New office construction simply was not feasible at that time, and no new office projects were built in the Seattle core from 1992 to 1997. However, by the mid- to late-1990s, increased job growth, followed by an incredible boom in the technology sector, led to rapidly declining vacancy rates, rising rents and net absorption of over 5 million square feet of office space. With rising rents, new office space became feasible to develop, and the resurgence in the demand for office development sites was underway.

Residential development followed the office construction boom as a byproduct of increased office occupancies. Multifamily development all but stopped by 1995, and over 1,400 permitted units were never built. The next wave of new construction started in 1997, with 1,370 new units added to the market place over the four-year period, ending last year. Another 1,023 units are planned or under construction for 2001. Like the office market, rising rents have made residential development feasible again.

The variety of zoning designations in Seattle’s central business district is a function of the targeted use for the submarkets that surround the financial core. Downtown Office Core 1-450’ (DOC1-450) is the most intensive zoning designation in the downtown area. This designation carries a maximum floor-area ratio (FAR) of 14 after consideration of public enhancement and design bonuses. By way of example, a 20,000-square-foot DOC1-zoned site could achieve a 280,000-square-foot office development. Uses in DOC1 are limited to traditional office or hospitality uses.

The DOC2-300’ zoning designation has a lower FAR of 10, but developers can add a residential component to the design that does not count against the FAR calculations. For example, a similar 20,000-square-foot site might be able to achieve an FAR close to 18 or 20 with 15 floors of residential development on top of 10 floors of office, maximizing the development to a 300-foot height limit. This type of development was completed by Martin Smith with Millennium Tower and is representative of what Bentall wants to build on the city block it is assembling just north of the Greyhound Bus terminal.

Developing a DOC2 parcel is not without its difficulties. A mixed-use development is less efficient in design, since it requires separate lobby entries, elevator banks and segregation of the parking areas between the two uses. It is also more challenging to finance. Institutional lenders prefer funding either office or residential developments more than mixed-use developments, and different underwriting criteria are imposed for each use. Therefore, obtaining financing is more difficult for these larger mixed-use developments.

Land is considered a component of project development cost and is typically purchased on a price-per-square foot of rentable area basis for office and a price-per-unit basis for residential projects. Land also sells with or without development entitlements, which requires having either a completed master use permit (MUP), allowing for immediate development, or having an MUP application in process. If the MUP is perceived to have value, a premium price will likely be paid because of speed-to-market advantages.

However, there have been a number of instances where downtown Seattle property sold with MUPs in place, but little or no value was allocated because the proposed development had to be redesigned. This was more frequent in the early 1990s than today where an MUP traditionally adds substantially to the property’s value, as was the case with Martin Smith’s Millennium Tower development, and arguably, Martin Selig’s acquisition of his Fifth and Jackson office development at Union Station.

An unentitled site is much more costly and time consuming to develop. Martin Selig paid $38 per square foot of rentable area for his entitled site at Fifth and Jackson. John Goodman paid about $31 per square foot of rentable area for an unentitled site on the former Societe Candy block just west of the Colman Building, a price considered top dollar by many industry experts.

One of the best benchmark transactions is Pine Street Investors’ purchase of the half-block parcel located just west of the Bon Marche parking garage at the southeast corner of Second Avenue and Stewart Street. The 27,300-square-foot site closed in September 2000 for a price of around $11 million, just over $400 per square foot of land area, or about $25 per square foot of rentable area without development entitlements. The buyers are planning a mixed-retail/hotel/housing development that will achieve an FAR of 16.

Fringe CBD locations are experiencing similar market interest, with some of the better South Lake Union properties commanding values in excess of $125 per square foot, and in the Denny Regrade, some of the prime sites are trading for upwards of $200 per square foot of land area.

Development activity in Pioneer Square and the International District is strong, but is constrained by stringent design review requirements and lack of adequate land supply. There is also growing interest in the next new close-in growth market for housing located between Madison Avenue and Harborview Hospital, just east of Interstate 5.

Another factor that could influence how developers view downtown land is the “super bonus” program being proposed by the Seattle Office of Housing. Select areas located on DOC1, DOC2 and DMC-240-zoned land could receive a 30 percent height increase. That would add up to 72 feet for a DMC-240-zoned property and 135 feet for a qualified DOC1 site. Developers would be required to obtain transferable development rights (TDRs) at a cost that has yet to be determined. The proposal still needs revision and will require City Council approval that is not certain at this time. But if approved, the potential up-zone could impact the value of a qualifying property.

Despite some anticipated setbacks in Seattle’s office market due to technology company failures and potential over-building, land will continue to be in high demand, but the wave of sales activity will probably slow from its unprecedented rate over the past two years.

The window of opportunity to sell at these prices may be closing, and some landowners will have to wait until the next construction boom — unless, of course, they have an attractively located site that is permitted and ready to develop.

Peter K. Shorett, MAI, CRE, CCIM, is senior vice president and director of Shorett Kidder Mathews & Segner Valuation Advisory Group.

Other Stories:

- New workplace model: the old town square

- Retailers take to the streets

- Hopes run high for Tacoma’s future

- Power crisis calls for collective action

- From broker to owner: Craig Schafer tells why he made the switch

- What’s rental housing’s future? Watch TV

- NW lenders keep the green light on

- Tenant’s lament: should I stay or should I go?

- 10 years of GMA: we’ve only just begun

- Growth management can be good for business

- Why we shouldn’t worry if NW industrial market softens a bit

- NW retail: more bricks and more mortar

- Seattle’s design review: tips for success

- Financing in an uncertain economy

- Office market slowing, but future looks good

- Should technology drive building design?

Copyright ©2009 Seattle Daily Journal and DJC.COM.

Comments? Questions? Contact us.