Surveys

DJC.COM

December 7, 2007

Now is the time for apartments — but beware!

Gardner Johnson LLC

Gardner

|

How times change. Along with many others involved in real estate, I have not-so-fond memories of the apartment market after the last development boom and we may be seeing the edge of a similar pattern developing right now.

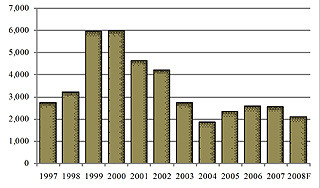

In 1999 and 2000, the Central Puget Sound region delivered an average of around 6,000 units of apartment housing; a very impressive figure driven in part by low interest rates as well as the ready availability of high levels of capital looking for a place to sit. Unfortunately, this delivery of new product coincided with the recession of 2000-01. Not only was that an issue unto itself, but we also started to see losses of tenants to home ownership as interest rates sank to 45-year lows.

As we all remember, it took several years for the market to absorb these additional units and return to balance. We saw concessions in more than 70 percent of all projects and developments halting, some in mid-construction.

Development dropped off precipitously at that time, but we have started to see a rebound. In the near-term this has not been an issue as when we consider market units lost to conversion activity, we have actually seen a net decline in overall units over the past three years, and will certainly see the same this year.

A different economy

Source: Dupre + Scott Apartment Advisors The number of apartments delivered is making a rebound after peaking during the dot-com heyday. |

Today’s environment is markedly different from that in the beginning of the decade. Economic growth has averaged 3 percent for the past three years and we are looking forward to stable, albeit restrained, growth for the balance of the decade. The effects of the crisis in the subprime mortgage market have started to filter into income properties and have increased the number of renters who cannot qualify for less conventional mortgages. Concessions have all but disappeared, and market vacancy rates are the lowest that we have seen in seven years.

Property managers are increasing rents (recent data from Dupre + Scott Apartment Advisors suggests that more than 80 percent of surveyed units plan rent increases), average rents have increased 26 percent since 2000 and the rental market appears to be in great shape.

So why my concern? As we all know, economics is known as the dismal science and our job is to find fault with markets.

If history tells us anything, it is that real estate is a cyclical market subject to peaks and troughs, and housing (rentals and for-sale) tends to be the last to fall in a cycle. We saw a substantial build up in new construction activity in the mid- to late ‘80s, followed by a lull through the ‘90s, which eventually led to increasing development activity in the late ‘90s and into this decade. We are now at the end of a lull that has been exaggerated by conversion activity and the loss of tenants to home ownership.

A difficult call

Forecasting new supply in a market that is subject largely to the whims of the capital markets is very difficult. We say that a project can be included if there is already a hole being dug, but even then it may not end up as originally intended.

If we look further into the future, we see that 2009 has the potential to be a pivotal year with the possibility of almost 9,000 units being delivered. One should also note that this number does not include any proposed condominium development that may covert to apartments if we do not see improvement in the for-sale market.

Seattle income projects are certainly getting a lot of attention from institutional real estate investors at present, with the likes of Kennedy Wilson, ING, Deutsche Bank and Wachovia all considering developments in the area driven, for the best part, by our surprisingly resilient economy.

That being said, many projects are being developed on the premise of increasing rents. With current rents not able to cover replacement cost, developers are forecasting increasing rents in order to achieve respectable yields. This has been a common practice for many years and one that required more than a little optimism on the part of the developer. Whether the potential rent increases are going to be large enough to counter the risks associated with development is open to conjecture with the potential additional supply tapering rent growth further down the road.

TOD interest jumps

Looking outside of our core urban areas, we are seeing considerable interest in the development of apartment communities in suburban locations that are close to transit hubs. These emerging markets represent a viable way to locate people closer to transit services, retail and offices whilst offering more readily available land at a cost basis that is far less than the urban cores. Whilst the concept of transit-oriented developments is not new, we are seeing considerable interest in them from the development community.

It is our full expectation these areas will see increasing development activity in both the short and long terms. Land constraints in the urban cores and continued congestion lead us to believe these areas have the potential to offer a product that sets them apart from the traditional suburban competition, at rents below that of our inner cities.

With the potential for increasing supply in the market, differentiation from the pack will be as important in income properties as it is in the condominium market.

Matthew Gardner is a principal in the land-use economics firm of Gardner Johnson LLC in Seattle.

Other Stories:

- Commercial real estate continues its strength

- Retail evolves in mixed-use projects

- Use cost segregation to cut Uncle Sam’s bite

- Too many condos in Seattle? Think again

- An urban village emerges on Seattle’s First Hill

- Pros and cons of the Industrial Jobs Initiative

- What’s next for Seattle’s CBD office market?

- Developing retail? Here are some things to know

- Downtown becomes too pricey for disabled homeless

- Workforce housing shortage is a ‘silent epidemic’

- Will good times continue for our market?

- Full speed ahead as CBA turns 30

- CBA Insights speaker profile: Dennis Wilde

- CBA Insights speaker profile: John Parker

- CBA Insights speaker profile: Linda Berman

- Hot Eastside office market won’t get red hot

Copyright ©2009 Seattle Daily Journal and DJC.COM.

Comments? Questions? Contact us.