Surveys

DJC.COM

December 11, 2008

Industrial market hums along, but don’t hold your breath

Pacific Real Estate Partners

Boudwin

|

We’re getting a little numb to the trials and tribulations of the market. One day it’s up and the next day it’s down. The stock market? Yes. But, also, the region’s industrial real estate market.

Recent challenges thrown at our local economy, the U.S. economy, and now the world economy, began in August of 2007 with the subprime mortgage meltdown, accelerated through the financial calamity of the September 2008 bailout mess and are firmly stuck in the disaster of the weakening economy, both domestically and globally.

Yet, the South Seattle, Southend and Pierce County industrial markets show some surprising resilience in the face of these economic challenges — and some impending weaknesses.

|

Regional summary

The Puget Sound region’s industrial market from south Seattle down through Pierce County is approximately 238 million square feet. With year-to-date new building supply at 1.76 million square feet and net absorption of available space at 1.71 million square feet, vacant space in the region did increase slightly from this year’s second quarter to the third by about 624,927 square feet, resulting in an increase in the vacancy rate from 4.32 percent to 4.56 percent, according to a recent CoStar Group report.

Industry experts consider any vacancy rate below 5 percent healthy.

However, this region’s industrial markets would be even healthier except that the ports of Tacoma and Seattle are experiencing a slowdown in container activity this year. Through October, the Port of Tacoma reports its container activity is down 2.4 percent from October of 2007, standing at 1.57 million TEUs (Twenty-foot Equivalent Units: the standard measurement of containerized cargo).

The Port of Seattle is much worse, down 11.5 percent from October of 2007, standing at 1.45 million TEUs.

All the West Coast ports are running between 1 percent and 10 percent less volume over the same time frame in 2007, except the Port of Vancouver, B.C., which is running at an increase of 3.55 percent.

The Port of Tacoma is widely seen as the best option in the region for users to expand their operations. NYK shipping lines demonstrated its preference as it chose Tacoma to develop a mega-terminal on approximately 168 acres of port land between the Hylebos and Blair waterways beginning in 2010.

So, what exactly is going on?

Vacant space

Within this region’s 238 million square feet of industrial product, each submarket tells us a different story.

The South Seattle industrial market consists of approximately 58 million square feet and has a very low 2.6 percent vacancy rate, level with the rate of the second quarter. The Southend, also known as the Kent Valley, industrial market consists of about 121 million square feet with a vacancy rate of 3.2 percent, down from 3.5 percent in the second quarter. The Pierce County industrial market consists of approximately 59 million square feet and has a vacancy rate of 9.3 percent, up from 7.7 percent in the second quarter.

These numbers reflect the fact that the only available land for significant new development is in Pierce County, where several large distribution centers are still vacant 12 months after construction completion and two more large facilities delivered in the third quarter added to the supply.

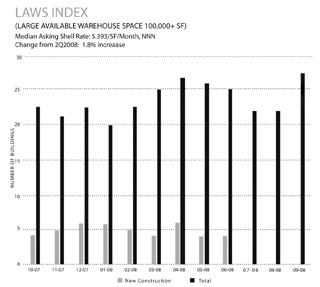

Pacific Real Estate Partners’ Valley Watch LAWS (Large Available Warehouse Space) Index shows 27 warehouse spaces with 100,000-plus-square-foot vacancies, totaling more than 6.4 million square feet in the market today.

New construction

The industrial market experienced moderating construction activity this quarter with 735,438 square feet of new industrial space completed, but only 291,922 square feet under construction. Most of the recent activity is occurring in the Pierce County submarkets of Sumner, Fife and Tacoma. The largest distribution center completed was NWBC’s Port Commerce Center at 598,000 square feet, with no pre-leasing.

In Sumner, the Adams building (235,000 square feet) was completed this quarter and the Benayora-Sumner building (264,000 square feet) will come online during the fourth quarter of 2008. While the Adams building has no signed leases at this time, the Benaroya building was bought by Toysmith.

In Puyallup this quarter, AMB delivered the Riverfront project of 388,000 square feet with no pre-leasing.

Total construction activity on an average annual basis over the last two years is about 4 million square feet. Overall, new construction for 2008 has slowed dramatically to 1.76 million square feet year-to-date with few new construction deliveries expected in the fourth quarter.

If vacancies are so low and construction is slowing, what exactly is going on?

Rental rates

Rental rates that have been escalating 6 percent to 9 percent per year since 2005 are becoming flat. Rates for users of more than 100,000 square feet are now in the 36-38 cents per square foot range. For deals from 50,000 square feet to 100,000 square feet, rates are at 36-40 cents. The most pressure on rates is in the size range of 250,000 square feet and larger, where rates are between 34 and 37 cents.

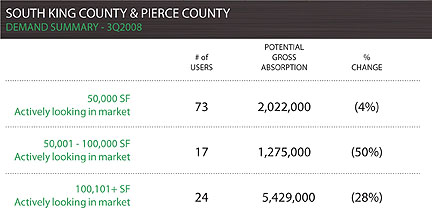

Market demand/absorption

Through the first nine months of 2008, a total of 1.70 million square feet of net absorption was completed, with activity trending downward. This was slightly lower than the pace set in 2007, which totaled nearly 2.26 million square feet by the third quarter. For 2007, total net absorption was 4.57 million square feet with tremendous leasing activity in the fourth quarter. That is not expected again this fourth quarter.

However, some notable lease signings occurred in the third quarter, such as United Natural Foods for 342,000 square feet in Auburn (renewal and expansion of 187,872 square feet), Puget Sound International renewing for 106,000 square feet in Tacoma and Chasing Fireflies signing up for 75,000 square feet in Tukwila.

Net absorption at the end of this year’s third quarter for South Seattle, the Southend and Pierce County was 1.71 million square feet. That compares to about 4.57 million square feet for the fourth quarters of both 2006 and 2007.

So, what exactly is going on? Well, demand is finally waning.

Land prices

Land prices continued to increase by an average of 35 percent in 2007, from $8.50 per square foot to approximately $11.50 per square foot. However, in 2008, with the latest financial market calamities adding to an already slowing economy, the pace of land sales has stopped in the third quarter.

Panattoni Development dropped its pursuit of 130 acres in Frederickson in September because it could not get an extension from the sellers and could not get a land loan for acquisition and entitlements.

Buyers are telling sellers that the price of land must come down by 25 percent to 50 percent because rents are flat and construction and entitlement costs have gone up. The sellers are moving slowly to accept this realty.

Zandorfy Development is marketing a 92-acre site in DuPont for $10 per square foot with all development permits in place. In fact, it has a building permit for a 790,000-square-foot warehouse — a rare entitlement in today’s market. To date, the seller has refused to counter several offers in the $6 per square foot range.

Jim Abbott of SGA Construction would like to get at least $10 per square foot for his fully entitled 20-acre parcel in Fife that has all the expensive site work finished. He has received two or three offers in the $5-$6 per square foot range.

Over the next five to seven years, it is likely that approximately 750 acres will be needed to support the growth of the ports of Tacoma and Seattle’s warehouse needs as container volumes are expected to grow substantially during the next cycle after recovering from this downturn. The South Seattle and the Southend are ill-equipped to support this growth with little to no land available for development, forcing users to look farther south down the I-5 corridor to Pierce, Thurston and Lewis counties.

Acquisition activity

The third quarter was slow for institutional investment sales. The one signature sale was AEW’s purchase in mid-July of Kent Distribution I & II. This fully leased industrial project totaled just over 524,000 square feet and was sold for a price of $38.9 million or approximately $74 per square foot.

Rreef introduced its fully leased 1.2 million-square-foot industrial portfolio, Park 277, to the market for sale in the third quarter. Bids were due Oct. 23, and the report is that the offering prices have been well below the seller’s expectations.

American Realty Advisors considered putting its 953,000-square-foot portfolio, 212th Business Park, for sale this summer, but delayed due to its high vacancy level.

Investco is in the same situation with its 188,000-square-foot, two-building industrial project in Kent. Remaining vacant spaces are almost leased, which will enable Investco to offer this industrial investment to the marketplace of buyers.

But, what buyers? Are there any? Yes, about half fewer than before because the financial world is upside down.

Are there any that are willing to pay the prices of just six months ago? No!

Les Boudwin is a principal with Pacific Real Estate Partners and has worked with industrial real estate properties for the past 24 years in brokerage and development.

Other Stories:

- CBA speakers take on the economy

- A green future for savvy developers

- Making green design deliver ROI, not just LEED

- Market District evolves as a walkable neighborhood

- Mixed-use projects can pay off handsomely

- Local retailers will fare better than others

- Suburban hubs will draw tomorrow’s renters

- Seattle’s office market: No more high-fiving

- CBA ready to mint a new breed of green brokers

- Weathering the storm

- Young guns take their shot at the market

- David A. Sabey

Sabey Corp. - Sean G. Hyatt

Trammell Crow Residential - Lynn Michaelis

Weyerhaeuser Co. - Dan Ivanoff

Schnitzer West - Commercial real estate prepares for the future

- The pitfalls of renting out condo projects

Copyright ©2009 Seattle Daily Journal and DJC.COM.

Comments? Questions? Contact us.