|

Subscribe / Renew |

|

|

Contact Us |

|

| ► Subscribe to our Free Weekly Newsletter | |

| home | Welcome, sign in or click here to subscribe. | login |

Construction

| |

|

May 11, 2023

Tepid appetite for local lab space continues

JLL

Curtis

|

The life sciences industry has not been immune to the macroeconomic challenges plaguing the global, national, regional and local economies (and it is unlikely we will see the heady times of late 2020 and 2021 in the near future), but these short-term challenges won’t be a roadblock for the incredible growth predicted over the long term. Science doesn’t stop, and investment in new innovations and advanced modalities will continue to drive the industry forward over the long-term horizon. While we’d never call any industry recession-proof, the life sciences industry is better positioned than most because of its countercyclical drivers that will sustain forward momentum.

Locally, Puget Sound life science employment has grown at the fourth fastest pace among peer biotech markets since 2015. Open positions rebounded sharply in the first quarter, rising across most occupations, with the largest increasing for medical scientists. Despite the job growth, the Puget Sound life science real estate market is no different than other top U.S. markets when it comes to real estate. It continues to be in transition, remaining dormant to start the year as the fourth quarter 2022’s tepid appetite for lab space carried into the first quarter of 2023. This was driven by 2023 economic and capital markets turmoil that started in 2022. As venture capital funding fell, marking the lowest quarterly volume since the third quarter of 2019, life science companies remained focused on preserving cash and paused near-term growth plans.

Puget Sound life science leasing is likely to remain limited for the remainder of the year while life science companies’ capital constraints remain. While venture capital dollars were few and far between in the first quarter of 2023, National Institutes of Health (NIH) funding continued at a healthy pace, supporting the region’s top research institutions. These institutions’ robust funding, as the region’s largest occupiers and consistent sources of biotech spinouts, bodes well for the market’s long-term health.

Downtown Seattle was similar to the overall Puget Sound region as leasing activity remained slim in the first quarter of 2023 with only one agreement signed. While companies largely remained on the sidelines to start the year, Bristol Myers Squibb’s 241,000-square-foot lease renewal at The Alexandria Center stands tall in a market that has averaged 453,000 square feet of annual leasing over the past five years.

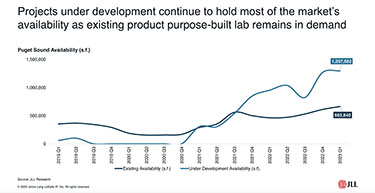

Seattle availability rose slightly in the first quarter, both on a direct and sublease basis, although most availability remained within under-construction product. And while market availability is largely direct, subleases have now reached 4.8%. Contrary to Seattle office sublease space, current lab sublease asking rates aren’t far off Graphics from JLL

from direct availabilities as the master tenants have sunk significant capital into buildouts. Seattle sublease rates closed in the first quarter at an average of $70 per square foot, triple net.

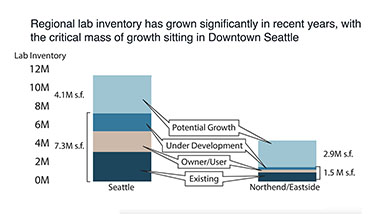

Northend-Eastside life science leasing activity remained in a holding pattern in first quarter as no deals were signed and vacancy increased by 30 basis points to 27.6%. But as the Puget Sound lab market has slowed and demand has fallen, a few large space requirements have skewed regional demand in Bothell’s favor. While the region’s largest lab requirements have their sights on Bothell, it remains to be seen whether the submarket can accommodate large companies seeking more than 100,000 square feet or if they’ll instead opt for larger sites beyond the traditional Bothell GMP cluster as Seagen did with its Everett facility.

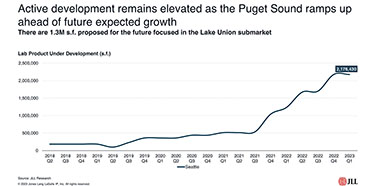

Puget Sound lab development remains robust as the market continues to quickly scale up. Following the market’s 13.2% expansion since 2020, current development is set to accelerate the lab market’s growth. As new projects deliver, it is likely that companies will continue to favor purpose-built lab over conversions while availability lasts. Lab space delivering through 2023 has been largely preleased, although projects delivering in 2024 and beyond remain available, resulting in 66.1% of the market’s current availability sitting in product under development. When economic conditions and funding improve, this will position the area well as it will have new, purpose-built product ready to accommodate growing companies in a market where the average biotech salary represents a significant savings over peer markets.

Touching on investment, lab capital markets remained silent through the first quarter following a quiet 2022. This marks the fourth consecutive quarter with no trades. The Puget Sound has seen relatively few lab properties trade historically as many investors and developers plan to hold their assets long term. It is unlikely there will be much in the way of transaction volume in 2023 as lab leasing remains on hold.

While economic and capital markets uncertainty remain, I expect the Puget Sound life science market to proceed with cautious optimism while planning for growth. Leases and development projects will be much more calculated, scrutinized and risk averse. Make no mistake — the Puget Sound will be on the radar for life science companies for years to come because of its human and physical capital.

Kris Richey Curtis is a managing director at JLL in Seattle where she specializes in working with biotech, technology and health care companies with their real estate needs.

Other Stories:

- Why Seattle has become a hotbed for life sciences

- New chapter for life sciences starts in the U District

- What does it take to convert offices to biotech lab space?

- Best practices for successful outcomes to complex health care projects

- ‘Supersized’ team finds success at Seattle Children’s Forest B

- Wellness nestles in the trees at The Evergreen State College

- Transforming the care model in the Rogue Valley

- The evolution of science: trends affecting the science workplace

- Considerations for successful adaptive reuse projects