|

Subscribe / Renew |

|

|

Contact Us |

|

| ► Subscribe to our Free Weekly Newsletter | |

| home | Welcome, sign in or click here to subscribe. | login |

Real Estate

| |

|

December 2, 2011

For offices, it feels like 2007 all over again

Cushman & Wakefield/Commerce

Bohman

|

In early 2007, the office market was really cooking with lots of construction cranes, robust tenant activity, rising rents and a strong economy.

In short, business was good. But by the end of 2007, signs were emerging that the economy was slowing down and stress was beginning to appear in the financial services sector. A year later, we were in the midst of a financial crisis as major financial institutions failed and massive layoffs followed.

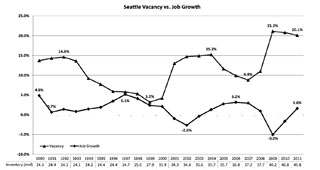

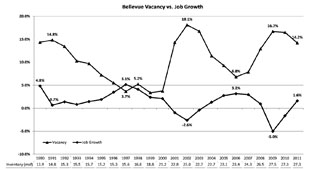

By just about any measure, 2009 was a tough year as employment growth screeched to a halt and new office construction that was in the pipeline was delivered vacant. Going into 2010, the Eastside was beginning to show some signs of life as leasing activity began to pick up in downtown Bellevue and the Interstate 90 corridor, but Seattle was still in decline. Speculation at that time was that vacancy rates in Seattle would keep rising, forestalling the recovery for years, whereas, the Eastside would continue to improve.

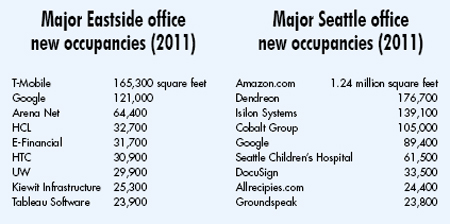

Fast forward a year and a totally different picture emerged. In 2011, the Eastside has improved but the buzz has really shifted to Seattle where explosive growth from the likes of Amazon.com has really changed the landscape.

Even more incredible, there are rumblings of new development in the pipeline and talk of a few speculative development projects starting. Despite a Seattle vacancy rate still in the 20 percent range, it feels a bit like 2007 all over again as Seattle landlords talk bullish about market trends and are getting their projects ready to go.

Meanwhile, the words “spec development” are not even in the vocabulary in Bellevue, where several projects are teed up in the CBD. But at 14 percent vacancy, no one is whispering a hint of breaking ground without significant pre-lease commitments.

Historically, office vacancy rates need to drop close to or below single digits before speculative development will be considered. In commercial office development however, timing is everything. Get in too soon and your project sits vacant while you wait for the market to catch up. Get in too late and your building could sit vacant until the next market up-cycle.

Today’s development environment is also being influenced by near-record prices being paid by institutional buyers with lots of cash to park in fully leased, “core” office investments. High prices in this market generally mean low yields on those investments and this, coupled with really low interest rates, makes a development project with greater upside potential attractive.

Big deals in Seattle

In office development, job growth is critical to fueling new development, and there is an inverse relationship between vacancy rates and job growth. Today’s downward trends of vacancy rates combined with the upward trend in job growth are powerful indicators that we are moving in the right direction.

Historically, the big driver in job growth on the Eastside has been Microsoft, which was responsible for leasing most of the new speculative construction in 2007 and 2008. Strong growth by Microsoft is generally mirrored in other parts of the Eastside as a general rise in economic activity tends to boost hiring. However, Microsoft’s office space expansion has been flat the past three years and we have not really seen the “mega” deals on the Eastside that put the extra juice in the last market cycle.

By comparison, a slew of larger deals in Seattle, including the hype generated with the Amazon leases, are pushing some Seattle landlords to behave more like they were back in 2007.

Another market dynamic is the continued flood of investment capital into the Seattle area where we have seen a number of near record sales of high-quality core assets in Seattle and Bellevue. Notable sales include Key Center in Bellevue at $444 per square foot to Kilroy Realty and 1918 8th Building for $524 psf and 818 Stewart for $557 psf, both sold to JP Morgan Chase.

These sales followed on the heels of several mega transactions in 2010, including the sale of the Bravern Office Towers in Bellevue at $548 psf and City Center Plaza at $531 psf.

During this two-year period, we also saw further cap rate compression, an indication there is still a lot of money on the sidelines chasing yields. In 2010, the cap rates on these large deals were in the 6 percent range while the deals in 2011 were in the 4 percent to 5 percent range.

To put into further perspective on how far the market has come in just a few short years, consider that the former Washington Mutual headquarters building (now Russell Investments Center) sold in September 2008, substantially vacant, for $133 psf. The property is now 91 percent leased and would likely fetch a premium price if sold in today’s market.

Submarkets struggle

These high-dollar-value sales are a positive market event for the owners of the highest quality well-located buildings where resulting market hype is pushing rents up, concessions down and acquisition prices to the point where many buyers will not go. By contrast, buildings in farther out submarkets such as east Redmond, Willows Road or Lynnwood continue to struggle. Tenants looking in these locations continue to be greeted with open arms and favorable economics while tenants looking in the CBDs will experience sticker shock on proposals going forward.

Typical of market recoveries in previous cycles, there is a flight to quality where tenants in lesser-quality buildings gravitate to higher-quality buildings in the best locations where some great deals can be found. This market cycle has been no different but many tenants are already finding that these high-quality spaces they recently toured are now more expensive or have been leased to other tenants.

So back to the opening question: Is it 2007 again? Market hype is building but “hiring hype” is not yet broadly based. Continued negative economic news, financial turmoil in Europe, lingering unemployment and political dysfunction over debt and deficit reduction makes business leaders tentative and cautious about major hiring initiatives.

So despite all the hype over possible ground-breaking ceremonies, it’s unlikely we will see new large-scale development until vacancy rates drop further or we see more hype on the hiring front. However, real estate market cycles have been remarkably predictable over the past 20 years and the charts clearly show we are moving in the direction of market recovery.

Tom Bohman is an executive director of the Brokerage Services Group of Cushman & Wakefield/Commerce, where for the past 22 years he has represented landlords and tenants in the greater Seattle/Eastside office market.

Other Stories:

- Insights breakfast is all about fundamentals

- Tourism, conventions, real estate — a valuable connection

- CBA Roundtable

- Strong vital signs for health-care real estate

- Investors turn aggressive on industrial properties

- Owners, here’s how to hire the right project team

- Blake Eagle

- Rob McKenna

- Brokers catch on to the green movement

- Banks find a comfort level for lending

- Jerry Yudelson

- Is multifamily’s future in ‘transit communities’?

- Retail begins to reset, refill