|

Subscribe / Renew |

|

|

Contact Us |

|

| ► Subscribe to our Free Weekly Newsletter | |

| home | Welcome, sign in or click here to subscribe. | login |

Real Estate: Crib Notes by Joe Nabbefeld

| |

By Joe Nabbefeld |

May 22, 2014

Crib Notes: Slim pickings for Seattle house hunters

Special to the Journal

She wants a 4-bedroom home in Seattle. For under $400k.

Just-livable condition would be fine. Nothin' fancy. Hold the granite, the stainless, the Bosh, the Miele. GE is fine. Heck, hold the yard.

Simple enough. Fire up the MLS search and ... NOT.

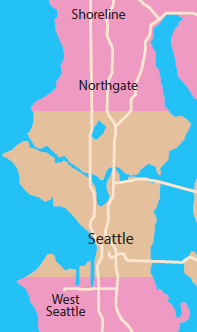

The map that came back spoke a thousand stark words.

No 4-bedroom home was available on the market south of 85th and north of Interstate 90 for $400k or less. None. Zero. Zip. Not even a raw fixer.

North of 85th: Lots. South of I-90, and over in West Seattle: Lots again.

If you've got more than 1 kid, you better have Income with a capital I or tolerance for a commute. Yuck.

Remember back 7, 8 years ago — that takes us back into The Boom (2006, 2007). You remember those days, before The Recession. All the hand-wringing about how expensive housing was getting. How unjust. The average family, the middle class — the teachers, firefighters, police officers, janitors, nonprofit heroes, boat makers, clerical staff, food servers, nurses, dental assistants, journalists, Realtor assistants — were getting priced out.

That concern went and hid somewhere when The Recession triggered The Great Reset. Affordability? When your own home value drops and drops, maybe to below what you paid, maybe even below what you still owe on it... the sudden silence was deafening.

The conversation is about to get switched back on. Two-plus years of price gains have swung the pendulum back.

Before we get to Crib palaver about solutions, let's play with some more data.

Run it at $400k to $500k, as I did on May 16. Ten hits, and two of them are 4-tiny-bedroom townhomes.

Also, by the way, a $400k purchase price with 20 percent down (that's $80,000, plus another $8k in closing costs) and a 4.25 percent interest rate gives you a $2,000 monthly mortgage payment (that's principal, interest, taxes and insurance).

Run it at $500k to $600k and you get 18 actives. Monthly payment for a $500k house (with 20 percent down, 4.25 percent interest) comes to $2,426. At $600k you're looking at $2,911 a month. Increase those interest rates, and ...

Does Crib Notes offer any solutions? First, there is no one solution. Second, be sure to tell every other hot city when you nail it. Third, any answers always begin with the word “choice.”

By that we mean adding more condos doesn't mean “everyone” starts living in stacked housing. It just adds another choice. Same with building more townhomes — yet another choice. Micro-apartments? We need those in the mix of choices, too. Converted shipping containers. Yurts.

Fourth on our list is supply. It's simple economics: Lower price by increasing supply. Supply supply supply.

Fifth is all the subsidies (which are mainly for lower income people) that do just fine at maintaining some in-city diversity.

Sixth is what I call “the glove.” Bunches of middle-income folk, the workers, will migrate out. And the best urban planning in response to that is good reliable mass transit options flowing into the center, where the jobs are, like fingers on a hand — or a glove. Maybe with a spider web overlay.

Either that or our under-$400k house hunter moves back in with her parents.

Joe Nabbefeld is a Realtor with Windermere Capitol Hill. You can reach him at http://www.RealSolutions.biz. He was the DJC's commercial real estate editor back in the late 1990s and early 2000s.

Joe Nabbefeld is a Realtor with Windermere Capitol Hill. You can reach him at www.RealSolutions.biz. He was the DJC's commercial real estate editor back in the late 1990s and early 2000s.

Previous columns:

- Amazon is fueling a home-buying frenzy, 04-10-2014