|

Subscribe / Renew |

|

|

Contact Us |

|

| ► Subscribe to our Free Weekly Newsletter | |

| home | Welcome, sign in or click here to subscribe. | login |

Construction

| |

|

April 30, 2010

Highway work expected to fuel demand for cement

Portland Cement Association

Sullivan

|

The economy is recovering. Two quarters of strong GDP growth and the emergence of job creation in March reinforce this point.

Though the core fundamentals are clearly improving, growth has been temporarily amplified by transitory inventory adjustments and census hiring. During the second half of 2010, the transitory inventory will disappear, census hiring impacts will cease and the American Recovery and Reinvestment Act (ARRA) stimulus impacts will fade.

Once these impacts diminish, the core fundamentals of the economy must be strong enough to feed a sustained growth recovery. Keep in mind, many of the factors that gave rise to the economic distress — namely, tight lending conditions, high foreclosure rates and weak job markets — will remain in play during the second half of 2010, albeit at diminished rates.

The combined impacts of reduced transitory economic stimulus and continuance of adverse financial conditions imply recovery in the U.S. construction markets is expected to take place in the slow economic growth during the second half of 2010 and continue through the first half of 2011.

Cement use to rise

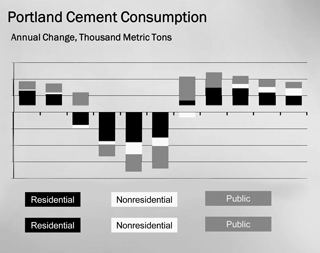

The Portland Cement Association expects a modest 3 million to 5 million metric ton increase over severely depressed 2009 levels will materialize during 2010.

This small increase must be put into perspective. Peak-to-trough cement consumption declined 54 million metric tons from 2005 peak levels — the worst volume decline in history. The marginal increase in cement consumption will offer little relief from distressed industry operating conditions, including low kiln utilization rates, extended plant downtimes and high inventory levels.

The modest anticipated recovery in cement consumption expected this year is not expected to come from the private sector. Of the 54 million metric ton peak-to-trough decline, 38 million metric tons, or 60 percent, are accrued to reduced private-sector demand.

Nonresidential cement consumption is expected to decline 26 percent during 2010, accounting for roughly a 2.5 million metric ton drag on cement consumption. This decline follows a 49 percent decline in 2009 and a 22 percent decline in 2008.

The expected decline in nonresidential construction reflects depressed expected returns on investment, or ROI, for commercial properties as well as the difficulties in securing financing. These conditions are expected to remain in place through 2010. Once job growth materializes, the fundamentals facing nonresidential consumption will begin to improve.

Keep in mind, large inventory excesses among nonresidential properties must be burned off before a recovery materializes. This will delay an outright increase in nonresidential construction until 2012.

Housing flat

Residential construction has stabilized, but a substantive increase in building may be another year away. Homebuilders are unlikely to accelerate construction activity until two critical conditions are met: first, that the inventory of unsold new homes reflects no higher than a five-month supply, and second, that home prices rise or stabilize.

Both conditions are likely to be required to ensure an adequate ROI for homebuilders to spur an increase in building activity. Lacking either condition, a substantive recovery in home building will not materialize. Neither condition is in place now.

A reduction in new home inventories and stabilization in new home prices must occur in a near-term environment characterized by weak economic growth, high unemployment, likely increases in foreclosure activity, fire sale pricing of bank-possessed properties (which acts as a depressant on new home pricing) and the continuation of tight lending standards. Combined, this environment is hostile to any significant near-term improvement in the fundamentals that would lead to an increase in housing starts.

Public work leads the way

The 2010 recovery in cement consumption lays squarely on expectations for public construction activity. This is based on two assessments: the magnitude and composition of 2010 ARRA spending, and the adverse impact of state deficits on 2010 discretionary public construction activity.

PCA expects ARRA spending will increase during 2010. More of this spending is expected to be on major highway construction projects, compared with 2009’s emphasis on resurfacing activity. This implies that ARRA spending will carry higher cement intensities this year than last year.

State deficits are expected to worsen during 2010. States have cut discretionary construction spending since 2007. Dramatic reductions materialized in 2009, leaving little more to cut or postpone.

While discretionary state construction spending is expected to decline further during 2010, the drag on cement consumption will be much smaller than last year. Unlike 2009, the magnitude of the decline in state discretionary spending is not expected to be large enough to offset gains attributed to ARRA.

Edward Sullivan is chief economist for the Portland Cement Association.

Other Stories: