|

Subscribe / Renew |

|

|

Contact Us |

|

| ► Subscribe to our Free Weekly Newsletter | |

| home | Welcome, sign in or click here to subscribe. | login |

Real Estate

| |

Lynn Porter Real Estate Editor |

November 2, 2006

Real Estate Buzz: Tarragon builds a whopper in Centralia

Real Estate Editor

Seattle-based Tarragon has nearly completed a 715,000-square-foot distribution center in Centralia for Michaels Stores. It will be one of the largest distribution facilities in the state, according to Tarragon President Joe Blattner.

Tarragon had an edge because it controlled the site when Michaels put out a request for proposals, said Blattner.

In the summer of 2005, Tarragon bought 100 acres on Harrison Avenue, just south of Exit 88 on Interstate 5, from the Port of Centralia. It won the contract a few months later to build the Northwest distribution center on half the land.

Michaels, which has been outsourcing its Northwest distribution management, signed a 15-year lease.

“We're big believers in the fact that port-driven industrial market is expanding down I-5,” Blattner said.

Among Tarragon's other projects is Kent Station. The 477,000-square-foot mixed-use center is on 18 acres at Fourth Avenue North and West James Street in downtown Kent. It will combine office, retail, entertainment and housing. The first two phases are done and more are planned.

Tarragon also is developing for lease or sale the two-building, 100,000-square-foot Cloverdale Corporate Park at 9400 Fourth Ave. S. in Seattle. The spec project is on a steep slope and took 13 months to get permitted by King County, but Blattner said it's rare to find such a large site so close to downtown.

The company tends to build industrial on spec because users make decisions quickly and want buildings fast, he said.

Blattner, who started out in construction and has been a developer for 12 years, said apartment projects in Seattle will become more feasible as time goes on. That's important to note, since Tarragon owns half a block on Third Avenue between Lenora and Virginia streets. In 2000, it intended to build a 20-story office/condo building there, but now the plan is for a 40-story apartment tower. Tarragon is working on permits, and will evaluate the next phase after that.

Vance sells Roffe for $13M

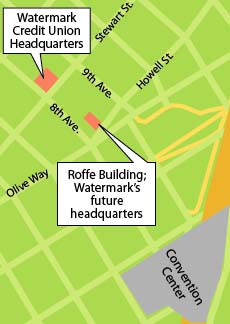

Watermark Credit Union recently bought the Roffe Building at 808 Howell St. from Vance Corp. for $13.5 million for its new headquarters, said Mark Houtchens of Vance. Watermark wanted to stay downtown and this puts it a block from its current digs at Eighth Avenue and Stewart Street.

That's where Schnitzer Northwest has said it plans to build a 32-story residential project, likely condos.

Schnitzer and Watermark representatives did not return calls for comment.

The first two floors of the Roffe Building were constructed in 1910 and the upper floors added later. Seattle-based Vance bought it in 1999 with minority partners for just over $2 million and did a major renovation, said Houtchens, who owns Vance with James Falconer.

Watermark intends to occupy the Roffe in August 2007, said Houtchens. Leases are in place, so the credit union will initially take four of the six floors in the 44,000-square-foot building, and eventually all of it.

Vance Corp. owns six office buildings in downtown Seattle, totaling 500,000 square feet. It tends to buy and hold, but Watermark's was an attractive offer, said Houtchens, adding: “We're looking for other opportunities.”

Sounds like some spree

Equity Residential recently bought the 128-unit Belle Arts apartments at 111 108th Ave N.E. in Bellevue (excluding commercial space) from Renton-based Seco Development for $30.2 million to convert to condos.

That left Seco with a chunk of change.

“Now I can go shopping again,” said Seco President Michael Christ after selling the complex, which the company developed with an investment partner in 2000.

Christ said because of the high-end nature of the company's projects, it wants to buy a development site in an affluent market, such as downtown Seattle, Kirkland or Bellevue.

Seco would do condos, if the site is right, or even retail. Mostly likely, however, it will build apartments with retail as “that's our greatest expertise,” Christ said. Then again, he said Seco might buy an historic building and rehab it.

Young, and up and coming

Commercial Property News in its Oct. 1 issue named John Miller, Cushman & Wakefield's senior managing director for the Pacific Northwest, one of the stars to watch in the industry.

The publication reports Miller, 37, who joined Cushman in late 2004, said he was most proud of expanding the company's presence regionally.

“People did not look at Cushman & Wakefield a year-and-a-half ago and see them as a formidable brokerage firm (in the area),” Miller is quoted as saying.

The firm has 24 brokers in Seattle and 18 in Portland — up about 30 percent from a year ago. Total revenue for Puget Sound operations increased by 80 percent in 2005 from a year earlier, the publication reported.

Miller previously was at Seattle-based Unico Properties as general manager of the Metropolitan Tract, a 1.8 million-square-foot real estate portfolio of 10 contiguous acres downtown.

Lynn Porter can be

reached by email or by phone

at (206) 622-8272.

Got a tip? Contact DJC real estate editor Brian Miller at brian.miller@djc.com or call him at (206) 219-6517.

Previous columns:

- Real Estate Buzz: Give your regards to old Broadway, 10-19-2006

- Real Estate Buzz: Val Thomas, Lorig Associates unite, 10-05-2006

- Buzz: What retirees like about living downtown, 09-21-2006

- Real Estate Buzz: Doing his part for real change, 09-07-2006

- Real Estate Buzz: Bremerton's waterfront blossoms, 08-24-2006

- Real Estate Buzz: Does Seattle need more high-end apartments?, 08-10-2006

- Real Estate Buzz: Wysong snaps up the Press for $32M, 07-27-2006

- Real Estate Buzz: Waterfront Place sold, with a 'cherry on top', 07-13-2006