|

Subscribe / Renew |

|

|

Contact Us |

|

| ► Subscribe to our Free Weekly Newsletter | |

| home | Welcome, sign in or click here to subscribe. | login |

Special Issues

| special issues index  February 24, 2000 | ||

|

Stand-up retail not going away anytime soon Traditional stores offer the social experience that e-tailing can�t

By SEAN ROBINSON Against the rising tide of e-commerce, traditional bricks-and-mortar retail will crumble like a sand castle - or so conventional wisdom suggests. The reality is somewhat different, though online retail spending broke new records in 1999. Internet commerce experts at Forrester Research report that holiday spending on the Web soared to $4 billion, compared to $650 million in 1997. Harbingers of doom for stand-up shopping, right? Wrong, according to Art Wahl, a retail specialist with the commercial services company CB Richard Ellis. "There�s sure no shortage of people who want street retail space," he said. "You try and get a good site in Seattle - you can�t." Though e-tailing has attracted its share of consumers, veterans of the retail wars are adjusting. Some fight back with so-called "Xtreme Retailing"tactics: flashy entertainment, carnival rides and celebrity appearances. Others don�t have to. Pure convenience - typically the ally of e-tailers - still favors some bricks- and-mortar businesses.

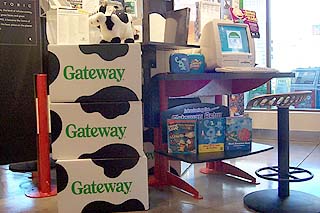

Across the retail spectrum, one word crops up repeatedly: experience, as in the shopping experience. The bricks-and-mortar folks depend on it - some more than others. Consider Pike Place Market or other marquee retail destinations. "The bricks-and-mortar retail offers an experience," Muhlebach said. "You don�t always want that experience to acquire a product, but sometimes you do. A mother and daughter are not gonna get the same experience on a computer as they do walking in Bellevue Square. There�s a social aspect to it that e-commerce doesn�t provide." E-tailers face other obstacles. Customer loyalty is harder to win, and there are still a few bugs in the system. A post-holiday survey by Jupiter Communications, a NASDAQ company specializing in e-commerce, pointed to a familiar set of concerns about e-tailers: inventory shortfalls, high shipping and handling costs, and slow site performance. Atmosphere trumps convenience when consumers want entertainment. It doesn�t matter as much to the "working" shopper picking up essentials. Retailers in the drugstore category are competing for the territory in between. It�s a hot area, said Susan Zimmerman, a vice president at Kidder Mathews & Segner, a real estate services company. In response to emerging online retailers, the bricks-and-mortar stores are expanding the drugstore category to include impulse products and small services, such as gift-wrapping. "If you�re gonna buy diapers, you don�t need to know what they look like - you know what they look like," said Zimmerman. "But if you�re gonna buy something that�s not so generic, like cosmetics, like gifts, like cards - you want choice." Other retailers are already falling in line with the forecasts of real estate industry observers, who envision a future of marketplace hybrids, combining traditional and online services. It�s the AOL/Wal-Mart effect. REI (Recreational Equipment Incorporated), the Seattle-based outdoor outfitter, fits the profile. The company, founded in 1938, combines online retailing with an expanding bricks-and-mortar presence. New outlets are opening this year in Denver and Japan, according to spokeswoman Jennifer Lind. The company has three Web sites: the home page (rei.com), a second for off-price shoppers (reioutlet.com), and a version of the home site written in Japanese. A long history in the mail-order industry may have made the transition easier. The jump from mail-ordering to e-tailing is short, and REI made it four years ago. "We�ve been doing the retail mail-order warehouse distribution thing for a long time," said Lind. "And those things are crucial to having e-business as well." The Web site functions in the "shopping basket" framework familiar to e-shoppers. A click on a product category leads to a page of selections, which leads to list of brands, models and prices. The e-tailing element extends REI�s geographic reach into the outdoor recreation market, and strengthens ties with mail-order customers in remote areas. The company is competing on every front. "We call it three ways to shop," said Lind. "If you want to shop online, we have that option, if you want to come to the store, we have that option, and if you want to order by phone or mail-order, we have that option." Though online purchasing continues to become a more viable choice for consumers, the example set by REI and other retailers suggests the experts are right about hybrids. Even high-tech companies, such as Gateway Computers, are getting into the bricks-and-mortar act. They have opened four stores in the Seattle metro area and probably will open five more, according to Zimmerman, the company�s Puget Sound-area broker. This supports the notion that all roads leading to consumer still are open. "People still like the shopping experience," said Zimmerman. "Shopping is an industry in itself."

|