|

Subscribe / Renew |

|

|

Contact Us |

|

| ► Subscribe to our Free Weekly Newsletter | |

| home | Welcome, sign in or click here to subscribe. | login |

Special Issues

| special issues index  February 24, 2000 | |||

|

The 2000 DJC Commercial Real Estate Marketplace Special Issue The commercial real estate industry surges as never before as the players work to take advantage of the stupendous market Over and over the pros agree: purveyors of commercial real estate in the Puget Sound region rarely have had it this good. As Daily Journal of Commerce staff members interviewed developers and brokers about their plans for 2000, each and every one swooned over the extraordinary strength of the bull market.

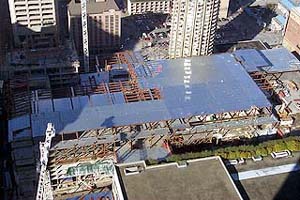

This must have been what it was like during the Klondike Gold Rush, which fueled Seattle's first big boom the last time one century ticked into another. Tom Parsons of Opus Northwest LLC compared the preceding year and a half to a bullet train ride. Another developer, Gary Carpenter, compared the strength of the market to a different type of a train, a freighter. "It's just remarkable," added Jon Runstad, chairman and chief executive officer of Wright Runstad & Co., the Seattle investment builder that has developed more than 10 million square feet since its start in 1972. "And the level just seems to go higher." Millions of feet of commercial space are under construction in the region yet no one thinks there's much danger of overbuilding. Look at the record low vacancy rates and all the preleasing activity. During the last boom cycle, new commercial space might sit empty for years. These days it's being snapped up even before the construction cranes are moved on site. The result is a staggering increase in rents. Al Hodge, a broker for the Broderick Group, has predicted rents for new leases will climb by 20 percent and that rates for renewals will blast up 70 percent. More than just tower cranes and rents are reaching skyward. Look at the accompanying graph, which shows how much commercial real estate traded hands in King County alone last year. The tally hit $1.4 billion, outstripping 1998 by an astounding $500 million. Tom Abbott, the Cushman & Wakefield senior director who presented these numbers at a recent forecast breakfast, expects the frenzied pace to continue. Investors are interested in the Seattle-area market and want in on the action.

As for the sellers, Abbott anticipates those roles will be taken by a couple types of owners. The first are those who do not have enough real estate in Seattle to make the big play; they'll take advantage of surging prices to unload property and move the resulting capital to other markets where they have a more dominant stake. The second class of sellers will be developers who feel they have added what value they can to their properties. Abbott does not believe the market has peaked. "The word I have been using for while is plateau," he said. Based on continued low vacancy rates and strong job growth, he opines the market will stay on this plateau at least during the coming year. Beyond that, it depends on vacancy rates, he added. To be sure, there are some troublesome issues on the horizon. Interest rates continue creeping upward. One developer, Joe Blattner of Tarragon, said the Endangered Species Act has hindered progress on some of this company's projects. And no one has unsnarled the region's traffic tangles. Then there are concerns about the long-term viability of these dot-com companies that are fueling much of the market. Surely the boom will go bust just as the Klondike and all other previous good times did. Perhaps this time, though, developers and financiers will cover their bets well enough to avoid the harsh consequences. As detailed in this special section, real estate experts are not ignoring the potential trouble. Nor are they letting them get in the way of the good times the likes of which modern-day Seattle has never seen.

- MARC STILES Journal Real Estate editor

STORY INDEX

Double-Shot Downtown

A tale of two markets

Simply regulating development is a fishy way to save salmon

Tacoma's Transformation

Dot-coms twist notion of supply and demand

Lights are burning bright in the Kent Valley

Even in good times, risk still abounds

Renton ratchets up to ride the wave

Eastside tenants take a whopping 2M square feet in �99

Stand-up retail not going away anytime soon

A return to retailing in the neighborhood

Meeting tech companies� needs requires creativity

It�s an institutional game - or is it?

Major changes may be in store on lodging front

Plugging into the future

2000 DJC commercial real estate survey

Eastside warehousing the latest on the endangered list

|