|

Subscribe / Renew |

|

|

Contact Us |

|

| ► Subscribe to our Free Weekly Newsletter | |

| home | Welcome, sign in or click here to subscribe. | login |

Real Estate

| |

|

December 10, 2010

Apartment owners: Here comes the rebound

Colliers International

Schumacher

|

Levin

|

Apartments have been bouncing back in most submarkets around the Puget Sound since the first quarter of 2010. According to data from Dupre + Scott, vacancy for the tri-county area has already returned to normal at 5 percent, from the third quarter 2009 peak of 7.2 percent. Around the Puget Sound region, we have seen concessions fall off dramatically, and the rental market recovery is firmly under way.

Record sale prices

Puget Sound area apartment sale prices have come back stronger than predicted. During the recession, apartment values fell off sharply. In many cases, a given apartment’s estimated value in September 2009 may have been 20 percent lower than its estimated value in September 2007.

The average price per unit paid in the Puget Sound area in 2010 for apartments 50 units and larger was $132,275 — the highest level ever. That is just higher than the previous peak of $129,231 in 2007 and well above last year’s trough of $100,635 per unit. The average age of apartments sold in 2010 is just over 30 years, so the sale data is not entirely skewed by sales of new apartments such as Equinox in Belltown at $321,078 per unit.

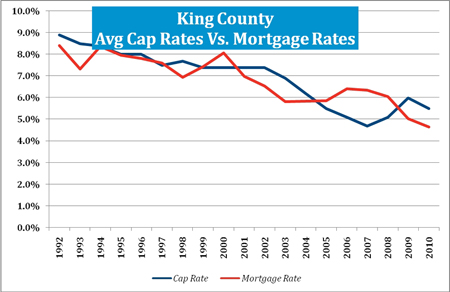

Rental income has not increased enough to cause values to return so quickly. Cap rate compression is the key here. The average cap rate for King County sales this year is 5.55 percent versus last year’s average 6.87 percent cap (average 6.46 percent over previous 10 years). Cap rates will continue at these historically low levels in the first half of 2011. However, there is a strong correlation between cap rates and interest rates. Interest rates cannot stay this low forever, and some cap rate decompression is likely to follow.

Not surprisingly, apartment sales essentially froze when values dropped. On average, 61 apartment buildings with 50 units or more have sold every year over the past 10 years in King and Snohomish counties, and the apartment sales volume record was set in 2005 at 138. In 2009, there were just 10 sales, and so far in 2010, there have been just 18.

We predict that sales volume will increase dramatically in 2011 as more sellers come to market to take advantage of current cap rate compression.

Landlord’s market

The supply-demand curve has already begun to shift back in the landlord’s favor, and tenants can expect their rents to rise significantly over the next three years. Supply will remain relatively flat for the next couple years, but demand will grow — outpacing supply into 2013.

More units were delivered in 2009 and 2010 than usual (5,752 and 4,096 respectively), but the new development pipeline has cleared out considerably. Just 1,773 units are under construction and/or planned for 2011 with another 2,400 units in the planning stages for 2012. The prior 10-year average is 2,915 new units per year. New development will start ramping up, but supply will still lag well behind demand for rental housing into 2013.

Growing demand

Supply may be fairly flat, but demand is on the rise and will contribute to a rental market that heavily favors landlords. Three factors will drive demand and growing rents over the next several years:

| What’s ahead for apartments? |

|

Rental market:

• Development will lag behind demand through 2012. • Rents will grow at greater than 6 percent annually through 2012. • Occupancy will be higher than 95 percent through 2012. Apartment values: • Net operating incomes should increase 10 percent to 15 percent over the next two years. • Apartment values will continue to increase in 2011. • Apartment sales volume will increase substantially in 2011, returning to more typical levels. • The current historically low cap rates will persist until after interest rates begin to increase. |

1. Recovering employment. Unemployment was the main factor that dried up rental demand and caused rents to fall 15 percent to 20 percent peak-to-trough in many cases during this downturn. Historically, when unemployment rises, demand for apartments drops, and that certainly appears to have happened here. Unemployment is still hovering in the 9 percent range. As unemployment recovers over the next several years, demand will grow dramatically.

2. A shift to renting versus buying. In the 2000 census, 36 percent of Puget Sound households were renters. At the peak of the housing bubble, it is estimated that just 32.5 percent of households were renters. In 2010, the percentage of renters in Puget Sound has returned to 35.7 percent. Foreclosures and lack of available credit are forcing some households to rent rather than own. However, a changing demographic and a change in mind-set are leading more households to choose rental housing. A growing number of baby boomers and other households that traditionally own are choosing to rent as a means of simplifying, or are opting out of purchasing in an uncertain economy.

3. Generation Y will drive demand. The biggest generation since the baby boom is reaching an age where they are entering the rental pool. Some 90,000 of them turn 22 in the Puget Sound over the next seven years. As a result, Seattle’s pool of renters will grow faster than it has in decades.

Dave Schumacher and Joe Levin of Colliers International specialize in the sale of multifamily investments in the Puget Sound area.

Other Stories:

- Local markets buoyed by cluster-based economic influences

- Can’t get financing? Try an SBA loan

- Facing bankruptcy? Try using a receivership first

- CBA Roundtable

- Don’t cut corners on building operations

- Is it time to check back into hotels?

- Industrial market inches toward a bright 2011

- Retail drives successful mixed-use projects

- Office sector: Light at the end of the tunnel

- Allen Shoup

- Bill Pettit

- John Swanson

- Here comes the ‘new normal’ for apartments