|

Subscribe / Renew |

|

|

Contact Us |

|

| ► Subscribe to our Free Weekly Newsletter | |

| home | Welcome, sign in or click here to subscribe. | login |

Real Estate

| |

|

June 13, 2013

Apartment investing? demand remains robust

Hendricks

Leith

|

Dudunakis

|

We’ve been saying it for years: Everyone loves Seattle and the Puget Sound region. From a multifamily and commercial real estate investment perspective, institutions, REITs, private capital and investment advisors have been active here for a very long time.

This injection of capital has come on strong over the past 30 years, and in the past decade, investment activity has catapulted the region to a perennial top 10 investment market in the world’s strongest economy.

Why? There are several reasons: Greater Seattle and the Eastside are considered the commercial, cultural and advanced technology hub of the Pacific Northwest, and Seattle is a major port city for trans-Pacific trade. The region’s economy is diverse, with key sectors that include health care, biotechnology, aerospace, philanthropy, higher education and information technology.

There is not enough room to list all the major employers and Fortune 500 companies based in Seattle, but a few high-impact notables such as Boeing, Microsoft, Amazon.com, the military and the University of Washington have helped shore up our local economy when many others have yet to fully recover.

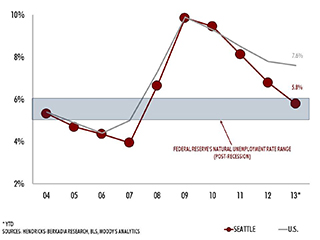

As it relates to incomes and rent-growth potential, the W.P. Carey School of Business at Arizona State University named Seattle third in the U.S. for job growth from January 2012 to January 2013. According to Moody’s Analytics, the Seattle metro unemployment rate has fallen 180 basis points year-over-year to 5.8 percent in April.

The local jobless rate is well below current national unemployment of 7.6 percent and also falls within the unemployment range that is considered “natural” by the Federal Reserve.

Additionally, one in five jobs in the state depends on technology-based industries. The area has an average high-tech wage of $78,742 — the second-highest tech salary in the nation.

Take a look at two of our investors’ favorite companies: Microsoft and Amazon.

Microsoft has more than 40,000 employees with a presence of more than 14 million square feet in the region.

Amazon employs more than 15,000 workers locally. The Internet retailer recently moved into its new 1.9 million-square-foot campus in South Lake Union and is already outgrowing it. The 3 million-square-foot addition to its existing campus is a significant economic driver in any region and will undoubtedly spin off a multitude of businesses and job growth throughout the Pacific Northwest.

Here are three reasons multifamily investors love Seattle:

SUPPLY AND DEMAND

The Puget Sound region has always posted a good balance between job growth, in-migration and apartment housing stock.

The population is nearing 3.6 million residents, according to Moody’s Analytics.

Although construction has ramped up since the end of the recession, Seattle has historically been a high-barrier-to-entry market for apartment developers. We not only have challenging geographical barriers like water and steep slopes, but entitlement also takes quite a bit of time (multiple years in many cases), and our local residents are very mindful and educated on the process. How long did it take for South Lake Union to be rezoned?

Many are closely watching our latest wave of new construction. We recently surveyed the 43 projects that opened in 2012. Over half of the projects reported occupancies of 90 percent or better. Rents in the best locations quickly exceeded the $3-per-square-foot threshold. Managers are reporting high absorption rates and there are a number of cases of properties stabilizing in as few as four to six months.

While we might be on an accelerated pace for deliveries, The Puget Sound Economic Forecaster reminds us that the 30-year average is approximately 9,400 permits.

Other sources like Dupre + Scott dig a bit deeper. Typically, not every permitted unit is built. Case in point, we added 4,875 new units in 2012 and are on pace to add another 8,277 apartments this year and another 9,862 units in 2014.

Apartment occupancy levels in the metro area should remain healthy at the end of this development cycle. Panels of experts have been discussing the differences in the current economic cycle. Tom Parsons and Clyde Holland noted a key insight to their residents: they do not want a mortgage; they want flexibility and freedom. Apartment living provides this.

SALES

To date in 2013, the tri-county area has seen 103 transactions involving apartment buildings with 20 or more units. The market is positioned to repeat or beat last year’s sales of approximately $2.5 billion.

Healthy interest and investment activity persists, while average cap rates continue to stay low with interest rates. Cap rates for Class A core deals are in the sub-4 percent to the mid-4 percent range. Meanwhile, initial yields for suburban Class B deals are gravitating toward the 5 percent range and Class C cap rates typically start at 6 percent or higher.

More in-migration and population growth is predicted to lift the total number of residents by more than 80,000 people over the next two years, compared to projected apartment supply growth of less than 19,000 units during that time.

Owners that withstood the downturn are very happy these days and are positioned for further net operating income upside. Rents are back to pre-recession levels and steadily climbing.

FINANCING

The volume of deals getting closed is a testament to the availability of debt. Our company recently merged with Berkadia, a subsidiary of Berkshire Hathaway. We thought it best to include insight on the financing environment from our local expert and new colleague Louis Wiseman.

“There is plenty of capital for refinancing and stabilized assets,” Wiseman said. “Fannie and Freddie characterize our region as a strong market. Right up there with the top costal, port cities in the country such as New York City, D.C. and San Francisco. HUD is still the best source for high leverage, and rates are in the mid-3 percent range. Berkadia’s GSE volume should be roughly $6 billion by year-end.”

What’s next? We are fixing transportation, bringing back basketball and the sun is starting to come out. Who wouldn’t love our future?

Marty Leith and Kenny Dudunakis of Hendricks-Berkadia have more than 37 years of combined experience in the multifamily investment arena and are considered top brokers in the greater Seattle market.

Other Stories:

- Office design goes from ‘me space’ to ‘we space’

- Low-income Seattleites struggle to find affordable homes

- Breaking the residential logjam at Northgate

- Report: Millennials put the brakes on driving

- Marketing challenge: sell 90K passes before tolls went on 520 bridge

- Five reasons why Seattle’s housing market looks rosy