|

Subscribe / Renew |

|

|

Contact Us |

|

| ► Subscribe to our Free Weekly Newsletter | |

| home | Welcome, sign in or click here to subscribe. | login |

Real Estate

| |

|

December 11, 2014

Office market tightens as tech companies expand

Colliers International

Ford

|

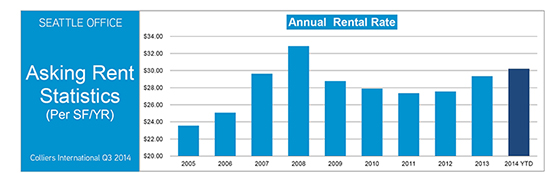

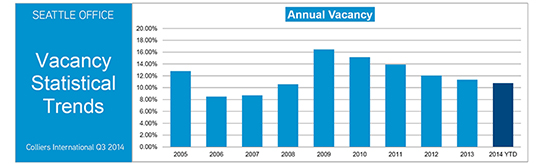

Seattle office rental rates are rising as tenant demand grows and vacancy continues to drop. Concessions such as free rent and options are shrinking, low-rise space is starting to lease at rates normally reserved for high-rise space, and tenant improvement allowances are holding steady even as the cost of construction is going up.

Several key drivers, in addition to an improving national economy, have contributed to Seattle’s tightening market that is beginning to rival the boom markets of 1999-2000 and 2006-2007.

Amazon

One word, one company. Amazon. The tech titan has grown in Seattle from 900,000 square feet in 2009 to over 5 million square feet today, not including an additional 2.2 million square feet it has under construction. It has leased most of the new office buildings that have been built in Seattle over the past five years and continues to take new space at an incredible pace.

Tech talent

Seattle, New York City and the Bay Area are widely considered to have the best available pool of technology talent in the U.S. All have colleges within close proximity that have world-renowned computer science programs and all offer fabulous amenities that attract young, talented tech people to their cities.

Seattle, however, offers a lifestyle that is more affordable for the younger technology demographic so we are seeing Bay Area tenants, in particular, open and grow offices in Seattle.

Although housing costs have continued to climb in the Seattle area, we are still far cheaper than the Bay Area or New York City. In New York City, a staggering 70 percent of one’s income goes to housing; in San Francisco, 60 percent. In Seattle it’s only 33 percent.

A young techie in Seattle can actually afford to move into an apartment or condo on a floor other than the basement and larger than 300 square feet that happens to be within walking (or biking) distance of where they work. Then, after work, they can walk their dog to one of the many parks on the water, go for a kayak ride on Lake Union or a bike ride on the Burke-Gilman Trail before they meet friends at a hip bar or restaurant, all within walking distance. On the weekend, they are within a one-hour drive to skiing, hiking, island hopping and boating.

Technology tenants

Less than 10 years ago, the only major tech companies with a substantial presence in the Seattle area were Microsoft and Amazon. Now more than half of new leases in the Seattle area go to technology tenants.

Google currently leases 500,000 square feet combined between the Eastside and Seattle. In Seattle, Zulily leases over 300,000 square feet, Zillow has 245,000 square feet, Disney has over 130,000 square feet for its tech division, Facebook leases 80,000 square feet and Twitter leases 40,000 square feet.

Even Nordstrom, which would not normally be thought of as a technology tenant, has seen tremendous growth in its technology division and occupies over 500,000 square feet in Seattle.

We have to assume that all these tenants are going to expand at least a little bit over the next 12 to 18 months, and there very well may be several companies that currently don’t have a presence in Seattle that will soon follow.

Professional service firms

Many professional service firms are earning more work as tech companies, both local and out of state, continue to grow in the Pacific Northwest. Companies are seeing the phenomenon of “2,000 additional square feet here, 10,000 additional square feet there” in their existing building due to the need to hire full-time employees as a means to handle the new workload, which is helping to drive vacancy down under 10 percent in many buildings.

When vacancy is driven down, what is driven up? Rental rates!

Tenant improvement allowances given for expansion spaces are generally much less than what would be given for new deals or renewals, and free rent on expansion spaces is becoming a thing of the past.

Migration to downtown

Technology tenants, in particular, are moving from suburban campuses to downtown Seattle and downtown Bellevue. Amazon moved from the outskirts of downtown with no amenities at Pacific Medical Center to South Lake Union. Microsoft is another great example. In addition to its Redmond campus, Microsoft has a significant amount of space in downtown Bellevue, where it has grown its presence over the last 10 years.

Weyerhaeuser just signed a lease for 165,000 square feet to move its corporate headquarters from Federal Way to Pioneer Square, with occupancy in the middle of 2016.

All tenants are competing for the best talent and it is easier to attract that talent in amenity-rich areas.

What tenants want

Tenants want new or updated buildings with great amenities: conference rooms, secure bike storage, decks, free on-site athletic facilities with showers and lockers. In addition they want light, bright and “cool” build-outs with open ceilings and on-site places to eat. They also want to be near parks, bike and running trails, good public transportation, lots of amenities and cool places to eat, like restaurants with some soul and food trucks on every corner.

Finally, let’s not forget they need room for growth, which is easier to find downtown. If the growth isn’t available in their existing building, then it’s usually available within a couple of blocks.

What do technology tenants want? Everything Seattle has to offer: colleges that generate excellent technology talent, great downtown amenities, sea-to-ski opportunities and a lower cost urban lifestyle. These elements are driving companies to open offices here and expand new divisions.

The explosive growth is quickly eating up our supply of office space, currently just over 10 percent vacancy, and driving up rental rates for quality downtown spaces that are at the highest rates since 2008 and are only expected to increase.

Laura Ford, a senior vice president at Colliers International with over 20 years of experience, specializes in office leasing in downtown Seattle.

Other Stories:

- Relax; the lodging market looks strong

- Survey -- Mack Urban

- Survey -- Daniels Real Estate

- Survey -- Harsch Investment Properties

- Survey -- Vulcan Real Estate

- Survey -- Capitol Hill Housing

- Survey -- Seco Development

- Sustainable workplace? Yes, but what about design?

- Don’t get rattled by earthquake insurance changes

- Become a big-shot developer with crowdfunding

- The ‘100 percent corner’ moves downtown

- Good news floods the South Sound market

- Here come more apartments; now what?

- Survey -- Skanska USA Commercial Development