|

Subscribe / Renew |

|

|

Contact Us |

|

| ► Subscribe to our Free Weekly Newsletter | |

| home | Welcome, sign in or click here to subscribe. | login |

Construction

| |

|

April 24, 2014

Reduce financial risk by tracking construction costs

Mortenson Construction

Wagner

|

As we emerge out of one of the largest economic downturns, many industries are reassessing their business approach and acumen to manage fluctuating expenses.

Construction activities are an important indicator for shifts in the economy because the complexity of the industry is driven by many smaller businesses and variable costs. Accurately estimating the cost of building materials is one of the most difficult components to success in the construction marketplace.

Evaluating escalation

Predicting construction cost escalation can be challenging but it is a foundational element to construction design and planning. Evaluating escalation includes raw and manufactured material availability, the premiums that come along with supply and demand, as well as labor availability in a booming construction market. Additionally, material availability is no longer at a local or regional level and now must be evaluated as an international resource.

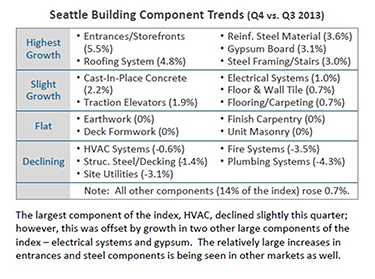

In 2007 and 2008 when the Puget Sound region was experiencing runaway escalation, commonly available indexes such as the ENR Building Cost Index (BCI) and the ENR Construction Cost Index (CCI) were showing 2 percent or 2.5 percent escalation while contractors were seeing 10 percent or 12 percent escalation in pricing. In response to the lack of accurate data and to reduce financial risk, Mortenson Construction started a new index for measuring construction cost trends.

The historically used BCI and CCI indexes measure a “grocery basket” of raw materials and raw labor, but they don’t fully account for subcontractor markups or premiums associated with supply and demand. The Mortenson Index measures what general contractors and owners pay in the market for “in-place” work, which includes the subcontractor and general contractor markups and labor.

With the Mortenson Index, each quarter select trade partners participate in an evaluation of a standard construction building for current market costs in geographic regions across the country. These figures are organized by building system and represent what general contractors can expect to pay for an in-place building. Mortenson can then use these figures to identify trends and predict future escalation levels.

What can we expect?

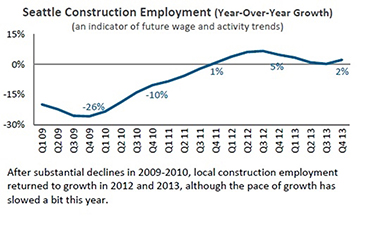

By coupling escalation trends, cost indexing and market research such as permit applications and the Architectural Billings Index (based on a 12-month lag), our latest figures show that a 3.5 percent escalation can be anticipated over the next 12 months, increasing to 4.25 percent escalation after those 12 months.

Labor is 40 percent of the cost of construction projects, making labor prices significant to the cost of in-place work. Labor agreements are set in intervals, trade-by-trade, every three years. Most recently, the agreements were set at the start of a downturn in the market when escalation was low. When they come up for renewal, it may be safe to expect a higher than historically average increase in wages to make up for the low spot in the last agreements.

As infrastructure and energy markets continue to boom nationally and in the Puget Sound region, we can expect the demand for copper to remain in high demand and even grow, affecting copper pricing in an already volatile market.

Controlling owner risk

Predicting escalation creates the opportunity to more accurately predict future cost trends and set in place strategies to minimize financial risk exposure for customers.

Contractors are able to significantly reduce the risk of escalation exposure to owners by leveraging negotiated contracting, public GC/CM or design-build that allows trade partners to be involved in a project early on. Under contract, the owner and contractor can strategically decide which party is best suited to carry the escalation risk — often times this is the party buying and installing the material. These trade partners can acquire raw and manufactured materials at optimal times to ensure minimal upside risk.

Another strategy to minimize risk is in the selection of design elements that have a common application and are widely available and familiar to the trades in the market. Enhanced competition for a given work element can hedge against escalation and attain the best price for a given element of work. Eliminating sole-sourced or even narrowly sourced work increases competition in the market and lessens the impact of premiums and markups.

Mark Wagner is chief estimator at Mortenson Construction, a national general contractor with a local office in Kirkland focusing on alternative project delivery and innovative use of technology.

Other Stories:

- ABC Awards • Eagle of Excellence • Mixed-Use Construction

- Survey: Skanska USA

- Survey: Andersen Construction

- Survey: BNBuilders

- Survey: J.M. Riley Co.

- Financing equipment? Know these 7 things first

- Builder’s risk insurance can be a subcontractor’s best friend

- Worker shortage ‘coming at us like a freight train’

- New law protects contractor proposal information

- What can public agencies learn from Bertha’s journey?

- Survey: Mortenson Construction

- Survey: Venture General Contracting

- ABC Awards • Mechanical Construction

- ABC Awards • Demolition

- ABC Awards • Institutional

- ABC Awards • Community/Public Service

- ABC Awards • Commercial Construction

- ABC Awards • Electrical & Communications

- ABC Awards • Specialty Construction

- ABC Awards • Tenant Improvement

- Survey: Abbott Construction

- Unique demolition project goes underground